October 10 – Read the newsletter below for the latest Mortgage Banking and Consumer Finance industry news, written by Ballard Spahr attorneys. In this issue, we discuss the next steps for employers after the FTC noncompete rule enjoined, the NFIP extension date, the Colony Ridge case, and much more.

- CFPB’s Chopra: Government Must Tackle Spiraling Refinance, Homeowners’ Insurance Costs

- Federal District Court on September 23, 2024, Entered Final Judgement in Favor of the CFPB in Lawsuit Challenging its Small Business Loan Data Collection Rule; Trade Groups Will Now Finally Appeal to Fifth Circuit

- VA Documentation Requirements for Allowable Fees

- Next Steps for Employers After FTC Noncompete Rule Enjoined

- NFIP Extended Until December 20

- Filing Instruction Guide for 2025 HMDA Data Submission is Released

- Corporate Transparency Act Litigation Update: 11th Circuit Hears Argument, and District of Oregon Rejects Preliminary Injunction Enjoining CTA Enforcement

- CFPB Blog: Debt Collectors Who Attempt to Collect on Spouses’ Medical Bills From a Survivor May Violate Federal Law

- FinCEN Reports Check Fraud Amounting to $688 Million Over Six Month Period

- Judge Refuses to Dismiss Most Reverse Discrimination Counts in Case Against Colony Ridge

- Looking Ahead

CFPB’s Chopra: Government Must Tackle Spiraling Refinance, Homeowners’ Insurance Costs

As interest rates drop, the CFPB is exploring ways to streamline mortgage rules to make the refinancing process easier and closing costs less expensive, Director Rohit Chopra said at a housing conference sponsored by the Center for American Progress.

“When an existing or competing lender is seeking to refinance a loan with a much lower rate for a substantially similar mortgage, it may not be worthwhile for the lender to repeat many of the steps that were taken during the purchase process,” Chopra said. “We are especially interested in the costs and time taken to refinance a mortgage that are exclusively related to complying with federal mortgage law, rather than steps that are demanded by investors.”

He said the CFPB will be looking for ways to “jumpstart competition” for various closing costs, which he said can help spur refinancing activity. However, he said that the CFPB cannot accomplish that goal alone.

“Lower closing costs lowers the barrier to entry for refinancing and makes refinancing more appealing to a broader swath of homeowners, especially for low- and moderate-income homeowners,” he said.

Chopra said that to prepare for the easing of interest rates, the CFPB has launched an effort to find ways to encourage more mortgage refinancing. The bureau, according to Chopra found that many homeowners face a “looming crisis,” cancellation and large premium increases for homeowners insurance. Chopra said that climate change, natural disasters and severe weather has led to large increases in the premiums that insurers charge. In addition some insurers are declining to renew policies altogether.

While the trend started in California, Louisiana, and Florida, that trend is now spreading nationwide, Chopra said. He said that some insurers are increasing their rates by between 30% and 60%.

“This pull back by insurers is driven, in part, by rising reinsurance costs – that is, the cost insurers pay to other financial companies to reduce some of their own risk,” he added, noting that the reinsurance companies that “sit behind” insurance companies are raising their costs and pulling back on insurance.

He said that the CFPB regulates the process by which mortgage servicers are permitted to enroll a homeowner into expensive insurance with limited coverage when their policy is canceled. He added that while that does provide some protection, it does not address the spiraling increases in insurance rates and its long-term impact on housing and the economy.

“As more homeowners are thrown off private plans and move to the limited public insurance plans offered in many states, state budget capacities could be pushed to the limit by future losses,” Chopra said. “I believe this problem will require greater involvement from financial regulators, housing policymakers, and fiscal authorities at the state and federal level.”

Chopra said that a comprehensive approach could include actions to lengthen the term of insurance policies to help avoid problems homeowners face when their policies are up for renewal. He added that a federal insurance or reinsurance program could address market failures.

The federal government’s National Flood Insurance Program, Terrorism Risk Insurance Program, and Crop Insurance Program “may provide both positive and cautionary lessons in thinking through a state-federal solution to this impending catastrophe,” Chopra said.

He added that as policymakers struggle with dealing with the insurance issues, the CFPB has proposed rules designed to streamline the process for homeowners to modify their mortgages when they face distress.

“Under our proposed rules, servicers would have to focus on helping borrowers – instead of foreclosing – when homeowners can’t make their monthly payments. This means servicers would have to stop dual track actions – taking steps both toward foreclosure and to help them – and would limit the fees they could charge borrowers, while they review possible options to help struggling borrowers,” Chopra said.

Chopra failed to mention that the CFPB’s ability to repay rule lacks the concept of a streamlined refinance loan, which is common with Federal Housing Administration (FHA)-insured mortgage loans. Various standard origination requirements do not apply to FHA streamlined refinance mortgage loans, based on the changes to the loan being limited to a lower rate and new loan term, which results in a lower monthly payment. Incorporating such a concept into the CFPB’s ability to repay rule could lower origination costs.

Director Chopra also does not expressly address that the CFPB has no authority to regulate the business of insurance, which principally a matter of state regulation.

Richard J. Andreano, Jr. and Reid F. Herlihy

Judge Randy Crane (S.D. Tex) ruled on August 26, 2024 that the CFPB did not exceed its authority under Dodd Frank when it issued its final Section 1071 small business lending rule. The court also rejected other Administrative Procedure Act (APA) challenges to the rule. However, the court did not issue a final judgment as, at that time, the court still had to rule on the two motions filed by certain plaintiff-intervenors: first, to amend their complaint to add a claim based on the illegality of the CFPB being funded by the Federal Reserve Board, when since September, 2022, “the combined earnings of the Federal Reserve System” has been negative and second, for judgment on the pleadings.

After the parties briefed those two motions, the plaintiff-intervenors withdrew their two motions without prejudice. The trade groups then requested Judge Crane to enter a final judgment against them which the CFPB did not oppose. Yesterday, Judge Crane entered a final judgment, which now clears the way for the plaintiffs to appeal that judgment to the Fifth Circuit Court of Appeals. We would expect a notice of appeal to be filed very soon, after which the record will be transferred to the Fifth Circuit and a briefing schedule will be established. Stay tuned!

Alan S. Kaplinsky, Richard J. Andreano, Jr., Loran Kilson, and Kaley N. Schafer

VA Documentation Requirements for Allowable Fees

In Circular 26-24-19, the Department of Veterans Affairs (VA) sets forth documentation requirements for fees and charges that may be imposed on veterans in connection with VA-guaranteed home loans, other than the VA funding fee and flat lender charge of up to 1% of the loan amount. The requirements are effective for loans closed on or after January 1, 2025.

The VA significantly limits the fees and charges that may be imposed on a veteran in connection with a VA-guaranteed home loan. Information on allowable fees and charges is set forth in the VA Lenders Handbook, Pamphlet 26-7. The VA advises in the Circular that “[l]enders must support the amount charged to or paid by the Veteran with an invoice or other document that clearly identifies the transaction and verifies the fee and associated charge (example: a recorded deed that displays the cost of recordation).” Additionally, the VA advises that:

- Lenders may not charge the veteran more than the actual amount charged for the fee or service performed.

- Lenders may not charge the veteran for services already paid for by another party.

- Invoices must be maintained in the loan file and provided to VA in the event the loan is requested for audit or review.

- If the lender is unable to support the charge with an invoice, a refund is to be provided to the veteran. If an overcharge is refunded prior to a VA review, evidence of the refund must be maintained in the loan file and provided to VA on request.

As noted above, the invoice requirement does not apply to fees included in the lender’s flat charge of up to 1% if the amount. Additionally, the invoice requirement does not apply to fees in the “Seller-Paid” or “Paid by Others” columns on the Closing Disclosure.

The VA addresses in the Circular that it may, in advance, authorize local fee variances for additional fees and charges that may be imposed on and paid by the veteran based on the location of the subject property. The deviations are set forth in a State Fees and Charges Deviation List that the VA publishes. The VA advises in the Circular that effective immediately, it will no longer publish maximum dollar amounts for most fees and charges on the list.

The VA acknowledges that certain government mandated fees paid by veterans at closing may not be received by the state or municipality immediately at closing and, therefore, there will not be an invoice at the time. The VA advises that such fees that are specifically identified on the State Fees and Charges Deviations list do not require an invoice, but the lender may not charge more than the amount listed. For the fees and charges included on the State Fees and Charges Deviations list without a maximum dollar amount, the veteran may pay reasonable and customary amounts, provided that the fees and charges are supported by an invoice.

Next Steps for Employers After FTC Noncompete Rule Enjoined

Summary

What’s next for employers who want to protect their businesses from competition from departing employees, including the loss of customers, employees, and confidential information? With a federal court injunction against the Federal Trade Commission’s (FTC) Final Rule banning noncompetes, the door is open for employers to continue using them. But companies now have time to reflect on the increasing hostility of courts and legislatures toward overly broad restrictive covenants, update their existing agreements, assess which employees ought to be subject to post-employment covenants, and determine how to best protect their trade secrets and confidential information.

Attorneys in Ballard Spahr’s Labor and Employment Group review the current state of federal law, note the growing number of states regulating noncompete agreements, and provide strategic considerations for employers.

Nationwide Injunction

Just two weeks before the effective date of the FTC noncompete Final Rule and the deadline to send notices to current and former employees about the invalidity of noncompete covenants, a federal court enjoined the Rule nationally. As we previously reported, on August 20, 2024, Judge Ada Brown of the U.S. District Court for the Northern District of Texas granted a nationwide permanent injunction against the FTC’s Final Rule. The Rule would have banned the use of nearly all noncompete agreements in the U.S. as of September 4, 2024. Specifically, the Rule sought to invalidate all existing noncompetes except for those of “senior executives,” and ban employers from entering into future noncompetes with any employees, including senior executives. The FTC has until October 19, 2024, to appeal the injunction to the Court of Appeals for the Fifth Circuit, and could potentially seek an emergency stay pending the appeal. Should the FTC choose to appeal, it faces an uphill battle—the Fifth Circuit has recently vacated two other federal agency rules: (1) the U.S. Department of Labor’s tip credit rule under the Administrative Procedure Act on the grounds that the rule is arbitrary and capricious, and (2) the private fund adviser rules from the Securities and Exchange Commission (SEC) on the grounds that the SEC exceeded its statutory authority. Similar lawsuits playing out in Pennsylvania and Florida district courts also increase the likelihood that the validity of the Rule may eventually be decided by the U.S. Supreme Court. On September 24, 2024, the FTC gave notice of its plans to appeal the U.S. District Court for the Middle District of Florida’s preliminary injunction, which temporarily blocked the Rule from applying to a local real estate firm, to the Court of Appeals for the 11th Circuit.

Notably, the National Labor Relations Board (NLRB) also attacked noncompetes last year with NLRB General Counsel Jennifer A. Abruzzo’s May 30, 2023, memorandum stating noncompetes violate Section 8(a)(1) of the National Labor Relations Act (NLRA), and instructing regional offices to begin litigating cases under this theory. On June 13, 2024, NLRB Administrative Law Judge Sarah Karpinen followed suit and ordered an employer to rescind a noncompete clause. Employers can expect to see further challenges to noncompetes under the NLRA.

State Restrictions

A growing number of states have enacted, or are in the process of enacting, legislation that bans or restricts the use of noncompete agreements. In fact, there are only a handful of states left that do not currently have any statute governing noncompetes, and which leave enforceability entirely up to the courts.

Noncompetes have long been banned in California, North Dakota, and Oklahoma. Minnesota joined these states in 2023 when it enacted a blanket ban on noncompetes. Washington, Oregon, Colorado, Illinois, Virginia, Maryland, Rhode Island, New Hampshire, and Maine have all placed income restrictions on noncompetes, meaning they are only enforceable against employees who earn above a certain amount per year. Massachusetts only permits noncompete agreements that include a garden leave payment of at least 50 percent of the employee’s salary during the restricted period or “other mutually agreed upon consideration.” Many states have placed various other restrictions on noncompetes, such as:

- Making them unenforceable against certain types of employees or industries (such as, hourly employees, news broadcasters, health care practitioners);

- Limiting their duration (such as six months or less presumed reasonable, two years or greater presumed unreasonable);

- Limiting their geographic scope (such as noncompete must specify by name that it applies only to the areas in which the employer conducts business).

Over the last several years, there has been increased activity in state legislatures to further ban or restrict the use of noncompetes and other restrictive covenants, including non-solicitation provisions.

Judicial Hostility

In addition to state statutes chipping away at noncompetes, courts have become increasingly hostile to employers’ attempts to enforce them. This is likely fueled by the FTC’s recent efforts to eradicate the use of noncompetes, and the media attention and public commentary viewing them as an unfair method of competition and unreasonably oppressive to employees.

Overall, it seems clear that courts are now applying heightened scrutiny and more stringent reasonableness standards when assessing noncompetes. In addition, courts are now more often invalidating entirely overly broad restrictive covenants, refusing to “blue pencil” them to a more reasonable scope as had been done in the past.

For example, in Ohio, a state where noncompetes are legal and currently unregulated by statute, a trial court recently declined to modify a noncompete it found to be overly broad, instead finding the entire covenant to be unenforceable and granting summary judgment in favor of the employee. On appeal, the First District Court of Appeals for Hamilton County affirmed, holding that the decision to modify an invalid noncompete is within the trial court’s discretion. Kross Acquisition Co., LLC v. Groundworks Ohio LLC, 2024-Ohio-592, ¶ 1, 236 N.E.3d 453, 455 (Ct. App.). In that case, the noncompete at issue prohibited its former salesperson from directly or indirectly working for competitors throughout Ohio and Kentucky for a period of two years.

The appellate court found that the geographic scope exceeded the employer’s service area, and further exceeded the areas where the employee had actually serviced clients; the temporal scope exceeded that necessary to protect the employer’s legitimate business interests; and the prohibition against working “directly or indirectly” for a competitor in virtually any role “did not bear a sufficiently direct relationship” to the employer’s legitimate interests. The court concluded that, with so many deficiencies, the trial court did not abuse its discretion in refusing to rewrite it to an enforceable agreement. This decision is a significant departure from Ohio courts’ tradition of blue penciling noncompetes that fail to meet its reasonableness standard, and an example of the nationwide judicial trend of generally disfavoring them.

Even non-solicitation agreements are subject to growing scrutiny, with some courts analyzing them under the same reasonableness standards as noncompetes. For example, some courts have upheld non-solicitation covenants only to the extent that they prohibit the solicitation of customers or employees with whom the former employee had direct contact during their employment.

The various tests of reasonableness used by state courts continue to shift and become more unpredictable, leaving employers with uncertainty as to how long their agreements will remain enforceable. Further, the “patchwork” of state legislation and the shifting judicial temperament governing the enforceability of noncompetes have made it increasingly difficult for multi-state employers to adopt uniform agreements.

Strategic Considerations for Employers

So, when employees leave, how can employers best protect their good will and confidential information from being used to advance their competitors’ businesses?

The first step is to re-evaluate which employees can and should be asked to sign a restrictive covenant. The use of “top to bottom” noncompetes, whereby virtually all employees in the organization are required to sign one, has a tendency to water down the importance of the restrictions. Focusing on the categories of employees where unfair competition is truly at issue, and being more selective about who is required to sign a noncompete, will enhance the argument that the covenants are necessary and reasonable. For example, executives with access to the most sensitive information, or sales employees who have nurtured customer relationships, may be prime candidates for noncompete agreements.

In addition, noncompetes may not be “one-size fits all.” Employers should consider the design of the covenants and whether some employee categories justify a greater restriction than others – in time, scope, and/or geography. The same analysis should be done in terms of the specific nature of the covenants each employee category is asked to sign – noncompete, non-solicitation, confidentiality, non-disclosure, and/or specific protections for intellectual property.

These agreements should then be assessed for compliance with the state law where the employees work. Employers doing business in multiple states should particularly be aware of the nuances among jurisdictions and adjust their agreements accordingly. Because legislation and judicial decision-making are not static, covenants should be reviewed periodically. Agreements that are stale and have not been updated to reflect the trends in drafting, court decisions, and business realities, can be very difficult to enforce.

In states where noncompetes are banned altogether, consider alternative approaches to covenants, such as non-solicitation, confidentiality, non-disclosure, and intellectual property covenants. In states where noncompetes are still permitted, but regulated, there are ways to make them more palatable to the courts, such as with garden leave provisions, narrowing the duration and geographic scope, ensuring adequate consideration, and adding step-down provisions.

Ballard Spahr’s Labor and Employment Group routinely provides guidance to clients on the development and enforcement of post-employment covenants, as well as litigation involving enforcement. If we can assist you, please reach out to a member of our Group.

Read our other coverage of the FTC’s Rule here and here.

Brian D. Pedrow and Cecilia N. Nieto

NFIP Extended Until December 20

The House and Senate on September 25, 2024 passed legislation that would extend key parts of the National Flood Insurance Program (NFIP) until December 20, 2024. The extension is included in H.R. 9747, which also would provide funds for much of the federal government to keep operating until that date.

President Biden has said he will sign the legislation. Absent the enactment of this legislation, funding for the NFIP and many federal programs would expire on September 30, 2024—the end of the federal government’s current fiscal year. The December 20 date allows Congress to delay enacting longer-term legislation to extend the NFIP and government funding until after the 2024 election.

Congress has been unable to enact a long-term extension of parts of the NFIP. As has often been in the case in recent years, Congress has included an extension of the authorization of the NFIP in short-term and end-of-year appropriations measures.

Many members of Congress have introduced legislation providing for a long-term extension of the NFIP, and hearings have been held on the topic, but Congress has not acted on any of the long-term bills. Since the end of fiscal year 2017, 31 short-term NFIP reauthorizations have been enacted, according to the Congressional Research Service (CRS).

If the authorization for parts of the NFIP had been allowed to expire, (1) flood insurance contracts entered into before the expiration would continue until the end of their policy term of one year, (2) new policies could not be issued, and (3) the authority for the NFIP to borrow funds from the U.S. Treasury would be reduced from $30.425 billion to $1 billion. According to the CRS, any expiration of the NFIP to issue new contracts would have serious consequences for the real estate market.

With past NFIP lapses, borrowers were not able to purchase flood insurance to close, renew or increase loans secured by property that required flood insurance. The CRS estimated that during a lapse in June 2010, each day more than 1,400 home sale closings were canceled or delayed. That represents more than 40,000 sales each month.

A potential alternative for home buyers and homeowners if the NFIP were allowed to expire would be to utilize private insurers to obtain flood insurance. As previously reported, rules of the Farm Credit Administration, FDIC, Federal Reserve Board, National Credit Union Administration, and Comptroller of the Currency authorize their regulated entities to use private flood insurance, and rules of the Department of Housing and Urban Development authorize the use of private flood insurance with mortgage loans insured by the Federal Housing Administration. Fannie Mae and Freddie Mac also permit the use of private flood insurance that meets their requirements. Although the private insurance market is growing, most property located in a special flood hazard area is insured through the NFIP.

Richard J. Andreano, Jr. and Reid F. Herlihy

Filing Instruction Guide for 2025 HMDA Data Submission is Released

The CFPB recently announced that the Filing Instruction Guide (FIG) for the submission of Home Mortgage Disclosure Act (HMDA) data collected in 2025 is now available. The FIG, issued by the Federal Financial Institutions Examination Council, may be accessed here.

HMDA data for 2025 must be submitted on or before March 2, 2026. The data usually is required to be filed by March 1. However, March 1, 2026 is a Sunday, so the data must be filed by Monday, March 2, 2026.

The FIG sets forth how data must be formatted before it is submitted to the CFPB HMDA submission portal.

Although there are certain updates in the FIG for 2025 HMDA data, the FFIEC said that are no significant changes to the submission process for data collected in 2025 and reported in 2026.

Richard J. Andreano, Jr., Loran Kilson, and Kaley N. Schafer

Various industry groups have filed lawsuits in multiple federal districts challenging the constitutionality of the Corporate Transparency Act (CTA). The first such suit, filed in the Northern District of Alabama, resulted in a ruling by the district court that the CTA was unconstitutional because Congress lacked the authority to enact the CTA. The government appealed this ruling, and the 11th Circuit heard oral argument on Friday, September 27. As we discuss below, the tenor of the argument suggests, although hardly compels, the conclusion that the 11th Circuit will reverse the holding of the district court.

Further, one week prior to the oral argument, on September 20, the District of Oregon rejected a motion for preliminary injunction to enjoin enforcement of the CTA, finding in part that plaintiffs had failed to show a likelihood of success on the merits in regards to a broad spectrum of constitutional claims. Although the District of Oregon did not issue a dispositive ruling on the merits, given the particular procedural posture of the case, the tenor of the opinion strongly suggests that plaintiffs’ lawsuit faces an uphill battle, at best.

Given the importance of the CTA and the existence of several other similar lawsuits in other federal districts challenging the CTA, both of these developments have been watched closely. FinCEN has estimated that over 30 million existing entities need to file reports regarding their beneficial owners (BOs) under the CTA by January 1, 2025. FinCEN also has indicated that, to date, only a small percentage of covered entities have done so. To the extent that entities may have been waiting to file their reports until a clearer picture of the CTA litigations materializes, they presumably should stop waiting. Although it is possible that a circuit split could develop, and that the U.S. Supreme Court ultimately could address and resolve the constitutionality of the CTA, the CTA still remains in force—with the current exception of entities affected by the District of Alabama ruling—and presumably will remain in force past January 1, 2025.

The District of Oregon Decision

In Firestone v. Yellen, the District of Oregon addressed and rejected numerous constitutional challenges to the CTA raised by plaintiffs seeking a preliminary injunction to enjoin its enforcement. Again, the court did not make dispositive rulings on the merits, but the tenor of the opinion is clear in regards to the likely outcome. In language relevant to the argument before the 11th Circuit, discussed below, the court found that “[t]he CTA imposes requirements only on entities with an apparent commercial character and does not require any individual to engage in a commercial transaction in which that person would prefer not to engage.”

The District of Oregon stressed that Congress passed the CTA to combat money laundering, the financing of terrorism, and other illicit financing activities. It observed that when “enacting the CTA, Congress amassed and evaluated vast amounts of data, considering testimony, reports, and interests of various stakeholders-ranging from law enforcement, the Executive Branch, foreign governments, intergovernmental expert bodies, journalists, small businesses, multinational corporations, the U.S. Chamber of Commerce, national security experts, international transparency organizations, the financial services industry, and others.”

With this background, the District of Oregon ruled that plaintiffs failed to prove their entitlement to a preliminary injunction because they were unlikely to prevail on any of the following claims:

- Congress lacked authority to enact the CTA under the Commerce Clause;

- Congress lacked authority to enact the CTA under the Necessary and Proper Clause;

- The CTA violates the First Amendment, in regards to compelling speech or interfering with free association;

- The CTA violates the Fourth Amendment as an unreasonable reporting requirement;

- The CTA violates the Fifth Amendment, as a matter of self-incrimination or vagueness;

- The CTA violates the Eighth Amendment, as an excessive fine;

- The CTA violates the Ninth Amendment, as to any substantive right to privacy; and

- The CTA violates the 10th Amendment.

11th Circuit Argument

As we blogged previously, the National Small Business Association (NSBA) and one of its individual members filed a lawsuit in the Northern District of Alabama challenging the constitutionality of the CTA, in part because Congress lacked the authority to enact the CTA. Before the district court, the government argued that Congress had such authority under three distinct enumerated powers: (1) its Commerce Clause-derived regulatory authority; (2) oversight of foreign affairs and national security; and (3) its power to tax. The district court held that the CTA was unconstitutional and enjoined its enforcement against plaintiffs.

Specifically, the district court held, in part, that the CTA was constitutionally defective because it attempted to regulate the act of incorporation, a purview of the individual States, in the name of national security. However, the district court opined that the CTA presumably would pass constitutional muster were its applicability limited to actual engagement in commercial activity by an incorporating entity (because such a limitation would serve as a “jurisdictional hook” tying the regulation to the flow of interstate commerce). The government appealed this ruling.

On September 27, the 11th Circuit held oral argument. The recording of the argument is here.

Prior to oral argument, the 11th Circuit requested supplemental briefing on the issue of whether the district court erred in not holding plaintiffs—who mounted a “facial” challenge to the CTA, rather than an “as applied” challenge—to their burden of showing that there are no constitutional applications of the CTA. The government’s supplemental brief is here; the appellees’ supplemental brief is here. In its supplemental brief, the government argued that, “[e]ven if plaintiffs had identified one or more entities regulated by the CTA but beyond the reach of Congress’s enumerated powers, . . . they plainly have not identified a sufficient number of such entities to cast doubt on the statute’s facial validity.”

At oral argument, counsel for the government stressed that the whole point of forming an entity is to engage in commerce, and that—according to the government—plaintiffs had not identified any actual corporation not engaged in commerce but covered by the CTA. Rather, plaintiffs had identified only hypothetical situations. According to the government, this was fatal to plaintiffs’ facial challenge. Relatedly, there was an exchange at oral argument regarding the proper standard for assessing facial challenges. The government argued that a two-step analysis applies: first, a court must ask, is the regulated activity inherently commercial; second, if not, a court then must ask if there is still a “hook” for Congress to exercise its power under the Commerce Clause. According to the government, the district court addressed the second question, but did not answer the first question—the answer to which is that the CTA generally regulates activity recognized as commercial, and is a proper exercise of Congressional authority.

Counsel for plaintiffs argued that Congress exceeded its Commerce Clause authority because the CTA applies upon incorporation, and therefore requires reporting from entities that are inactive and “just sitting there.” Counsel for plaintiffs also argued that the CTA assumes that any person incorporating an entity is a “criminal suspect,” and that the existence of the Customer Due Diligence (CDD) Rule under the BSA—which requires financial institutions such as banks to gather BO information from certain entity customers—renders the CTA unnecessary. In part, the government responded that the test for the Necessary and Proper Clause is not “absolute necessity,” and that the CTA and the CDD Rule have significant differences.

Finally, the appellate panel asked the government whether, if the 11th Circuit were to reverse the district court, it should remand the case to the district court to address plaintiffs’ Fourth Amendment claim. The government responded that it did not have a “strong view” regarding a potential remand, but noted that the CTA fits comfortably within Fourth Amendment jurisprudence.

If you would like to remain updated on these issues, please click here to subscribe to Money Laundering Watch. Please click here to find out about Ballard Spahr’s Anti-Money Laundering Team.

Peter D. Hardy, J. Chesley Burruss and Siana Danch

The CFPB recently issued a blog post, highlighting debt collection impacts on surviving spouses. In the blog, the CFPB warns that debt collectors who try to collect on a spouse’s medical bills from a survivor, who is not legally liable for the bills, may violate the Fair Debt Collection Practices Act and state law.

“Where debt collectors try to capitalize on a surviving spouse’s vulnerabilities by attempting to collect their deceased spouse’s unpaid medical bills without consideration of the specific facts and legal nuances that would be required to determine whether the bills are actually owed, these attempts to collect on these debts may therefore violate state and federal law,” the agency said.

The bureau noted that surviving spouses are especially likely to report having unpaid medical bills and those bills are larger than those of the rest of the population. According to the blog post, new surviving spouses report unpaid bills that average $28,749, compared with $15,785 for the rest of the population.

The bureau said that while facing emotional and financial challenges, many surviving spouses are contacted by collectors trying to collect unpaid bills for the care of their deceased spouses. They may not be required to pay those bills, according to the bureau.

“If a spouse dies, their estate is usually responsible for paying any remaining bills,” according to the bureau. “The survivor is generally not personally responsible for that debt unless it’s a debt the survivor also agreed to or the survivor is responsible under a state ‘common law’ doctrine or legislation.”

The CFPB said that its recent proposal to ban medical bills from credit reports would help ensure that debt collectors cannot use credit reports to coerce surviving spouses to pay medical bills that they do not owe. However, bureau officials noted that they have demonstrated that the medical billing and collection system is filled with errors, adding that debt collectors may be trying to collect on bills that are inaccurate.

“The CFPB will continue to pursue debt collectors for attempting to collect amounts from consumers that are not actually owed,” the bureau concluded. “We will work with state regulators and law enforcement to help identify debt collectors who attempt to collect on medical debts without regard to state and federal law, and to ensure that surviving spouses are able to easily understand their rights and responsibilities.”

Reid F. Herlihy and Joseph Schuster

FinCEN Reports Check Fraud Amounting to $688 Million Over Six Month Period

The Financial Crimes Enforcement Network (FinCEN) issued last month an in-depth report on check fraud stemming from mail theft (Report). This is a pernicious and expanding problem. The Report follows upon a joint alert issued by FinCEN and the U.S. Postal Service (USPS) in February 2023, on which we blogged.

Mail theft-related check fraud is the fraudulent negotiation of checks stolen from the U.S. mail. Check fraud refers to any use of paper or digital checks to fraudulently obtain funds, including alterations, counterfeiting, and fraudsters signing checks not belonging to them.

While mail theft often consists of mail being stolen from USPS mailboxes or personal mailboxes, the U.S. Postal Inspection Service reported that 412 mail carriers were robbed on duty between October 2021 to October 2022, and 305 were robbed in the first half of Fiscal Year 2023.

The Report analyzed data received from 15,417 Bank Secrecy Act (BSA) reports on mail theft-related check fraud received during the six month period from February 27, 2023 and August 31, 2023. FinCEN identified three primary outcomes after checks were stolen from the U.S. mail: (a) 44% of checks were altered and then deposited; (b) 26% of checks were used as templates to create counterfeit checks; and (c) 20% of checks were fraudulently signed and deposited. The check fraud was reported in every state, with large urban areas reporting more incidents.

Mail theft-related check fraud negatively impacts financial institutions because they typically have liability for check fraud losses as a paying bank for counterfeit checks and fraudulent signatures and the collecting bank for altered checks.

Check manipulation methodologies ranged in sophistication, and many perpetrators made mobile or ATM deposits to avoid interaction with bank personnel.

Unsophisticated methodologies included fraudulently endorsing a check without modifying any information on the check, altering the payee or dollar amount without washing the check, and negotiating a check with a pay to the order of the fraudster.

Moderately sophisticated methodologies included check washing, selling check information online, using compromised check information to create counterfeit checks, stealing newly ordered checks from the mail.

Sophisticated methodologies included opening new accounts in name of payee, romance and employment scams where victims act as mules to move the funds, and insiders at financial institutions or USPS.

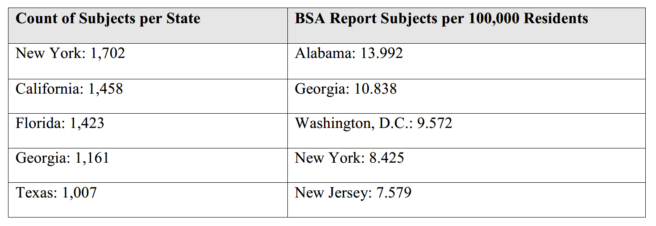

According to the Report, BSA reports involved the following five “top” states, in regards to raw numbers and per population:

As the Report reminds: when suspecting mail theft-related check fraud, in addition to filing a Suspicious Activity Report, financial institutions should refer their customers who may be victims to the U.S. Postal Inspection Service.

If you would like to remain updated on these issues, please click here to subscribe to Money Laundering Watch. Please click here to find out about Ballard Spahr’s Anti-Money Laundering Team.

Kristen E. Larson

Judge Refuses to Dismiss Most Reverse Discrimination Counts in Case Against Colony Ridge

Saying that reverse redlining is a form of discrimination, the U.S. District Court for the Southern District of Texas has refused to dismiss a discrimination case alleging that Texas developer Colony Ridge specifically targeted Limited English Proficient (LEP) people.

In issuing the ruling, the court dismissed a mortgage processing company from the suit, saying that the firm had not been involved in any lending decisions.

In December 2023, the CFPB and the Justice Department filed a complaint against Colony Ridge Development, LLC and three related entities (collectively, “Colony Ridge”) in which the agencies allege that Colony Ridge engaged in discriminatory targeting of Hispanic consumers with predatory financing and other unlawful conduct.

In rejecting Colony Ridge’s motion to dismiss, the court acknowledged that while the Supreme Court and the Fifth Circuit Court of Appeals have not ruled on whether reverse discrimination is a recognizable form of discrimination under the Equal Credit Opportunity Act, other courts have ruled that it is.

The DOJ and CFPB alleged that Colony Ridge has developed more than 40,000 lots spread across six residential subdivisions in Liberty County, Texas and that Colony Ridge has extended credit to consumers to purchase the lots. The additional facts alleged in the complaint include that:

- Colony Ridge advertises almost exclusively in Spanish. In its advertising, Colony Ridge features cultural markers associated with Latin America.

- Colony Ridge falsely represents that lots were sold with water, sewer, and electrical infrastructure already in place. It only discloses that lots may not have this infrastructure after applicants have paid a non-refundable deposit and the company makes that disclosure only in English.

- Colony Ridge employees fail to inform buyers of flood risk despite repeated past flooding of lots or falsely tell buyers that the lots have not flooded.

- Colony Ridge’s interest rates are significantly higher than prevailing rates. Colony Ridge’s interest rates are not based on an individualized assessment of risk related to a consumer’s actual likelihood of repaying the loan. Colony Ridge does not assess borrowers’ ability to repay before extending credit, requiring only self-reported–but unverified–gross income and a nominal down payment.

- From September 2019 through September 2022, Colony Ridge initiated foreclosures on at least 30% of seller-financed lots within just three years of the purchase date, with most credit failures occurring even sooner.

- Foreclosure and property deed records indicate that Colony Ridge flipped at least 40% of all the properties it sold between September 2019 and September 2022, selling approximately 8,237 properties twice, 3,267 properties three times, and 2,067 properties four or more times in three years.

With regard to legal matters, the complaint alleges that Colony Ridge:

- Engaged in unlawful discrimination against applicants in violation of the Equal Credit Opportunity Act and Regulation B, including by targeting Hispanic applicants on the basis of race or national origin with predatory seller financing.

- Engaged in unlawful discrimination against applicants in violation of the Fair Housing Act, including by targeting Hispanic applicants on the basis of race or national origin with predatory seller financing and exploiting applicants’ limited English proficiency.

- Engaged in conduct that violated the Interstate Land Sales Full Disclosure Act (ILSA) and Regulations K and J by:

- Selling lots without filing an initial Statement of Record with the CFPB and paying the required fee;

- Failing to provide purchasers with a printed Property Report in advance of signing a contract or agreement;

- Displaying advertising and promotional materials to prospective purchasers that were inconsistent with the information required to be disclosed in the Property Report (i.e., that the lots were subject to periodic flooding);

- Making misrepresentations or omitting material facts about the lots (i.e. representing they were sold with the infrastructure necessary to connect water, sewer, and electrical services pre-installed and omitting estimates of the costs required to connect those services); and

- Failing to file an Annual Report of Activity with the CFPB and to pay the required fee.

- Engaged in deceptive acts or practices in violation of the Consumer Financial Protection Act by misrepresenting that lots were sold with the infrastructure necessary to connect water, sewer, and electrical services pre-installed, and violated the CFPA based on the alleged ECOA and ILSA violations.

Richard J. Andreano, Jr. and John L. Culhane, Jr.

Post-Election Webinar - The Impact on the Banking and Consumer Financial Services Industry

A Ballard Spahr Webinar | November 12, 2024, 12:00 PM – 1:00 PM ET

Speakers: Alan S. Kaplinsky, John L. Culhane, Jr.

Subscribe to Ballard Spahr Mailing Lists

Copyright © 2026 by Ballard Spahr LLP.

www.ballardspahr.com

(No claim to original U.S. government material.)

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, including electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the author and publisher.

This alert is a periodic publication of Ballard Spahr LLP and is intended to notify recipients of new developments in the law. It should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own attorney concerning your situation and specific legal questions you have.