June 13 – Click on the headlines below to read the latest Mortgage Banking and Consumer Finance industry news written by Ballard Spahr attorneys. In this issue, we discuss the CFPB’s final rule regarding nonbank enforcement, the new EEOC pregnant workers rule, FinCEN’s newly released Year-in-Review, and much more.

- CFPB Issues Final Rule Creating Nonbank Enforcement Action Registry

- CFPB Issues UDAAP Guidance on Contracts for Consumer Financial Products and Services

- U.S. Supreme Court Punts the NBA Preemption Analysis Back to the Second Circuit

- This Week’s Podcast Episode: Did the U.S. Supreme Court Hand the CFPB a Pyrrhic Victory?

- CFPB Alleges Dark Patterns in Suit Against Fintech Peer-to-Peer Lender

- California’s DFPI Releases Third Annual Report on Activity Under the CCFPL

- Colorado Rate Exportation Litigation: Motion to Dismiss Complaint Claims There Is No Claim There

- New EEOC Pregnant Workers Rule Adds Requirements This Month

- CFPB Issues Semi-Annual Report to Congress; CFPB Director Chopra to Appear Before House and Senate Committees This Week

- FinCEN Releases Year-in-Review for FY 2023: SARs, CTRs, and Information Sharing

- FTC Provides Annual Report to CFPB Regarding Activities in 2023 Under Consumer Financial Services Laws

- Looking Ahead

CFPB Issues Final Rule Creating Nonbank Enforcement Action Registry

The CFPB issued its final rule, titled the Registry of Nonbank Covered Persons Subject to Certain Agency and Court Orders Final Rule, on June 3, 2024. The rule will require certain nonbank entities to register certain covered enforcement or court orders, and comply with ongoing, attested reporting requirements on the entity’s compliance with such orders. The rule is effective on September 16, 2024, with registrations available beginning on October 16, 2024 pursuant to a tiered implementation approach (discussed further below).

Immediately after the announcement of the final rule, the Conference of State Bank Supervisors (CSBS) issued a statement expressing its disappointment with the CFPB’s decision. The CSBS also reinforced the concerns previously expressed by state regulators during the consultation process, and in the CSBS’s comment letter, which it submitted along with the American Association of Residential Mortgage Regulators, the National Association of Consumer Credit Administrators, the North American Collection Agency Regulatory Association, and the Money Transmitter Regulators Association. Those concerns included the impact on small nonbank firms as well as the impact on state supervision and enforcement efforts.

“Covered Nonbank”

The rule applies to any “covered nonbank”, which is defined as a “covered person” under the Dodd-Frank Act, but excluding the following:

- insured depository institutions or insured credit unions;

- entities who are “covered persons” solely due to being a “related person” under the Dodd-Frank Act (e.g., controlling shareholders or independent contractors);

- a State;

- a natural person;

- certain motor vehicle dealers; or

- entities that qualify as “covered persons” solely because of conduct excluded from the CFPB’s rulemaking authority, such as activity related to charitable contributions.

“Covered Orders”

The rule applies to final, written public orders (“order” to include any written order or judgement in an investigation, matter, or proceeding) issued by agencies or courts, whether or not issued as a consent order, that meet the following criteria:

- Identifies a covered nonbank by name as a party subject to the order;

- Was issued at least in part in any action or proceeding brought by any Federal agency, State agency, or local agency;

- Contains public provisions that impose obligations on the covered nonbank to take certain actions or to refrain from taking certain actions;

- Imposes obligations on the covered nonbank based on an alleged violation of a “covered law”, which includes, but is not limited to, Federal consumer financial laws, other laws enforced by the CFPB, and certain unfair, deceptive, or abusive acts or practices laws, rules or orders at both Federal and State levels identified in the final rule; and

- Has an effective date on or after January 1, 2017, (however, note the Registration Information section below with respect to the impact of effective dates on which covered orders must be registered).

Registration Information

Covered nonbanks must register information on covered orders that either: (1) remain in effect as of September 16, 2024, or (2) have an effective date on or after September 16, 2024. The information that must be registered is outlined below.

- Identifying Information – This category will include basic identifying information for the covered entity.

- Administrative Information – This category may include information about the covered entity’s affiliates that are registered with respect to the same order.

- Covered Order Information – This category will include the following at minimum:

- a pdf upload of the fully executed covered order, with any non-public portions redacted as necessary;

- the issuing and initiating (if different) agency(ies) or court(s);

- the effective date of the covered order, and the date of expiration (if any);

- the covered laws found to have been violated, or for consent orders, those alleged to have been violated; and

- any docket, case, tracking, or other identifying numbers for the order.

Notably, certain aspects of the required information appears subject to change, as the final rule states that it will issue future “filing instructions” to specify the form and manner for electronic filings and submissions.

Annual Written Statement by Attesting Executive

Perhaps the most concerning aspect of the rule for industry is the requirement, applicable only to CFPB-supervised covered nonbanks, to review and submit certain written statement information, on an annual basis, regarding the registered covered orders. In addition, this requirement only applies to covered orders with an effective date on or after the applicable implementation date (as opposed to the broader requirement to register any covered orders that remain in effect through the effective date of the regulation).

Specifically, CFPB-supervised covered nonbanks must provide:

- the name and title of an attesting executive with respect to each of the registered covered orders; and

- an annual written statement, signed by the attesting executive, for each registered covered order.

The final rule states that the attesting executive shall be the company’s “highest-ranking duly appointed senior executive officer (or, if the supervised registered entity does not have any duly appointed officers, the highest-ranking individual charged with managerial or oversight responsibility for the supervised registered entity) whose assigned duties include ensuring the supervised registered entity’s compliance with federal consumer financial law, who has knowledge of the entity’s systems and procedures for achieving compliance with the covered order, and who has control over the entity’s efforts to comply with the covered order.”

As part of the annual written statement, the attesting executive is required to:

- Describe the steps the executive has taken to review and oversee the entity’s activities subject to the order during the preceding calendar year; and

- Attest whether, to the executive’s knowledge, during the preceding calendar year the entity identified any violations or instances of noncompliance with any applicable obligations imposed in the order’s public provisions.

Further, the CFPB-supervised covered nonbanks are required to maintain records sufficient to provide reasonable support for the written statement for five years after its submission.

Timing

Again, the final rule is effective on September 16, 2024, and registration can begin at the earliest on October 16, 2024. The rule provides for a tiered implementation of the requirement to initially register a covered order, and then separate timing requirements for ongoing registrations and for the submission of the annual written statements.

Registration of Existing Covered Orders During Implementation Period

For initially registering an existing covered order, the covered nonbank must register the order within the later of the end of the applicable implementation submission period, or 90 days after the effective date of the covered order.

The implementation submission periods are outlined in the following table below, which are based on the 90-day periods following the “implementation dates” defined in the final rule:

|

Covered Nonbank Type |

Implementation Submission Period |

Registration Deadline |

|

Larger Participant CFPB-Supervised Covered Nonbanks |

October 16, 2024 through January 14, 2025 |

January 14, 2025 |

|

Other CFPB-Supervised Covered Nonbanks |

January 14, 2025 through April 14, 2025 |

April 14, 2025 |

|

All Other Covered Nonbanks |

April 14, 2025 through July 14, 2025 |

July 14, 2025 |

During these implementation submission periods, entities must register covered orders that:

- Have an effective date from January 1, 2017 through the start of the covered nonbank’s submission period; and

- For covered orders issued prior to September 16, 2024, the covered order remains effective as of September 16, 2024.

The CFPB’s Executive Summary includes the following examples for illustration of the timing requirements:

“Assume an Other CFPB-Supervised Covered Nonbank has the following orders (that otherwise meet the definition of a covered order): 1) an order that took effect on January 1, 2016, and that expires on January 1, 2026, 2) an order that took effect on January 1, 2017, and that expires on October 30, 2025, and 3) an order that becomes effective on January 1, 2025, and that expires on January 1, 2031. During the applicable implementation submission period, the Other CFPB-Supervised Covered Nonbank:

- would not register the first order (effective January 1, 2016) because it took effect before January 1, 2017;

- must register the second order (effective January 1, 2017) because it took effect on or after January 1, 2017 (and prior to the start of the applicable submission period) and remained in effect as of September 16, 2024; and

- must register the third order (effective January 1, 2025) because it took effect on or after September 16, 2024, and prior to the start of the applicable submission period.”

Ongoing Registration Timing for New Orders

After the start of the entity’s implementation submission period, covered nonbanks must comply with ongoing requirements to register new covered orders and submit updates to existing covered orders. The following timing requirements apply:

|

Registration Submission Type |

Timing Requirement |

|

Updates or changes to a covered nonbank’s Identifying Information or Administrative Information |

Within 90 days after the date of the change |

|

Amendments to previously registered covered orders, including changes to submitted order information |

Within 90 days after the date the amendments are made |

|

New covered orders applicable to the covered nonbank, with effective dates on or after the start of the applicable implementation period |

Within 90 days after the effective date of the new covered order |

|

A revised filing if there is any termination or expiration of a previously registered covered order |

Within 90 days after the effective date of that termination or expiration |

Written Statement Submission

The written statements required from the attesting executive must be filed annually, on or before March 31 of each year, and cover any orders registered during, or prior to, the preceding calendar year. Again, unlike the broader requirement to register consent orders that remain in effect as of the effective date of the final rule (September 16, 2024), the annual written statement requirement only applies to covered orders with an effective date on or after the applicable implementation date.

In light of the tiered implementation approach, the following notable time frames will apply to the different categories of covered nonbanks:

- For Larger Participant CFPB-Supervised Covered Nonbanks that register by December 31, 2024, the first written statement submission is required by March 31, 2025. That submission will cover registered covered orders with an effective date from October 16, 2024, to December 31, 2024.

- For Other CFPB-Supervised Covered Nonbanks, the first written statement submission is required on March 31, 2026, and will cover registered covered orders with an effective date on or after the beginning of their implementation submission period of January 14, 2025 to December 31, 2025.

The CFPB’s Executive Summary also provides the following notable example to illustrate the timing requirements, in light of the registration date:

“If on or before December 31, 2026, a CFPB-supervised covered nonbank has three previously registered applicable orders (first registered prior to January 1, 2026) and two new orders (effective between January 1, 2026, and December 31, 2026, and registered, or required to be registered, by March 31, 2027), the covered nonbank would file written statements for each of those five orders on or before March 31, 2027. However, if a CFPB-supervised covered nonbank timely registers its first covered order between January 1, 2027, and March 31, 2027, and thus did not qualify as a supervised registered entity at any point during 2026, it does not need to file a written statement until March 31, 2028.”

End of Registration Requirements

The ongoing registration requirements apply to a covered order until it is deemed to expire under the final rule, or until all relevant provisions are fully terminated. As examples, a covered order may be terminated by an agency or court, or may terminate under its own terms on a date provided for in the covered order.

If the covered order does not expressly provide for a termination date, and is not terminated earlier, it is deemed to expire 10 years after its effective date pursuant to the final rule (apparently, regardless of any state law that might provide for an earlier termination date). However, if the order expressly provides for a termination date that is longer than 10 years, the order is not deemed to expire until the expressly provided termination date.

The final rule also requires notice to the CFPB within 90 days of the date of any modification, termination, or abrogation of the order. If either expiration or termination occurs, or the order is modified such that it is no longer a covered order, then after a covered nonbank files a final notice with the CFPB, the covered nonbank is relieved of further registration obligations with respect to that order.

Optional Alternative Registration for NMLS-Published Covered Orders

In recognition of the overlapping enforcement action publication function of the Nationwide Multistate Licensing System (NMLS), the final rule provides a one-time, alternative registration option for a covered order. This option is only available if the order is published on the NMLS and was not issued by the CFPB (either in whole or in part). If this option is elected, the covered nonbank must still file certain limited information on the CFPB registry (the nature of which is still to be determined), but is not required to register any changes to the covered order, or to file the annual written statements with respect to the order.

We note that this alternative option was not included in the CFPB’s proposed rule. Accordingly, it appears to be a limited concession to the concerns voiced during the comment period about the redundancy of the NMLS enforcement action publication function and the CFPB’s registry.

Published Information

The final rule states that the CFPB may publish certain information about registered covered orders on its website, but that the annual written statement submitted by the covered nonbank will be treated as confidential supervisory information.

Outlook

Industry will be rightfully concerned about this latest initiative of the CFPB. In particular, the annual written statement requirements will likely create untenable dilemmas for compliance personnel engaged in routine compliance management functions, against the backdrop of frequently vague and overbroad enforcement action terms. There is also the clear issue of the CFPB encroaching on the purview of its fellow regulators, which has been repeatedly voiced by those very regulators.

We think it is likely that this rule will be challenged in court, and we note the scant support for this initiative in the language of the Dodd-Frank Act. Specifically, the registration provision found in Section 1022(c)(7) of Dodd-Frank merely authorizes the following:

“The Bureau may prescribe rules regarding registration requirements applicable to a covered person, other than an insured depository institution, insured credit union, or related person.”

We further note that Section 1022(c)(7) requires that the CFPB consult with state agencies for any such registration system, stating:

“In developing and implementing registration requirements under this paragraph, the Bureau shall consult with State agencies regarding requirements or systems (including coordinated or combined systems for registration), where appropriate.”

Reid F. Herlihy, Richard J. Andreano, Jr. & John L. Culhane, Jr.

CFPB Issues UDAAP Guidance on Contracts for Consumer Financial Products and Services

On June 4, 2024, the Consumer Financial Protection Bureau (CFPB) issued a Consumer Financial Protection Circular 2024-03 (“Circular”) warning that the use of unlawful or unenforceable terms and conditions in contracts for consumer financial products or services may violate the prohibition on deceptive acts or practices in the Consumer Financial Protection Act (CFPA). In a related press release, CFPB Director Rohit Chopra said, “Federal and state laws ban a host of coercive contract clauses that censor and restrict individual freedoms and rights. The CFPB will take action against companies and individuals that deceptively slip these terms into their fine print.”

Under the CFPA, a representation, omission, act or practice is deceptive when:

- The representation, omission, act, or practice misleads or is likely to mislead the consumer;

- The consumer’s interpretation of the representation, omission, act, or practice is reasonable under the circumstances; and

- The misleading representation, omission, act, or practice is material.

In referencing their Bulletin 2022-05 on consumer reviews, the CFPB highlights that many federal laws invalidate contract terms and conditions that require consumers to waive consumer protections provided under federal law, such as TILA, EFTA, MLA, SCRA. The Circular states that covered persons may violate CFPA by including “unenforceable material terms” and such misleading practice cannot be cured by including a provision like “except where unenforceable” because consumer are misled into believing that a material contract provision is lawful and enforceable when they are not. The CFPB concluded that:

[C]onsumers are unlikely to be aware of the existence of laws that render the terms or conditions at issue unlawful or unenforceable, so in the event of a dispute, they are likely to conclude they lawfully agreed to waive their legal rights or protections after reviewing the contract on their own or when covered persons point out the existence of these contractual terms and conditions. Deceptive acts and practices such as these pose risk to consumers, whose rights are undermined as a result, and distort markets to the disadvantage of covered persons who abide by the law by including only lawful terms and conditions in their consumer contracts.

The circular states that CFPB supervisory examiners have identified violations of the CFPA’s prohibition on deception stemming from covered persons’ use of unlawful or unenforceable contract terms and conditions that claim to limit consumer rights and protections afforded by federal or state law. The CFPB provided examples related to limiting the right to contest garnishments, creating the misimpression that consumers could not exercise bankruptcy protection rights, waivers of the right to retain counsel, and misrepresenting consumer protections available under laws.

In March 2024, the CFPB issued a circular addressing deceptive marketing practices for remittance transfers. In the prior circular, the CFPB addressed concerns with the use of fine print to hide promotional conditions and marketing “free” services. While the CFPB uses “fine print” in its headline, fine print is generally used to describe an agreement where some text is printed in a much smaller font size to obscure important terms or where, similar to the March circular, the prominent marketing text does not include the material conditions and limitations of the product or service, which are instead disclosed in much smaller text in a footnote or below the scroll on the webpage. Despite this misnomer, we suspect the CFPB is addressing consumer protections, liabilities, and waivers that are included in account and loan agreements. These agreements are commonly several pages in length but generally use one font size throughout (usually 9 point or greater) and use bold or ALL CAPS fonts for provisions that may be of special importance to consumers (such as liability, waiver of jury trial, or arbitration provisions).

We recommend that companies review their consumer financial products and services contracts to identify and modify any contract terms that may violate the CFPA’s prohibition on deceptive acts and practices. Note that the CFPB will hold a company liable for misleading and unenforceable contract terms even if the terms are provided by one of the industry’s contract form providers or commonly found in industry contracts. Our attorneys are experienced in reviewing consumer contracts and can help companies mitigate any potential UDAAP concerns.

It is often not an easy task to identify contract terms that violate federal or state laws. Many companies have sought to protect themselves by using prefatory language such as “except where prohibited by law” in situations where the law is unclear as to whether a contract provision is lawful or where the company is using a contract in several states and the contract provision is unlawful in one or more states but not in all states in which the company does business. As stated above, the CFPB will consider such prefatory language to be deceptive. Companies must carefully scrutinize all consumer contracts to identify contract provisions that expressly or implicitly waive consumer rights or increase consumer obligations above what the law may allow, research the legality of such contract provisions, and excise provisions that violate and even arguably violate federal or state law. This is by no means a simple project. Companies will need to engage counsel experienced in consumer financial services law to do that work.

Although some have questioned whether the issuance of this circular one day after the release of the final rule for the “Registry of Nonbank Covered Persons Subject to Certain Agency and Court Orders” may mean that the CFPB has decided to abandon finalizing the proposed registry of form contracts used by certain nonbanks, we believe that the CFPB has not abandoned the registry. In the proposal for the registry, the CFPB included the following contract terms, some of which may not be covered by the Circular because they are lawful:

- precluding the consumer from bringing a legal action after a certain period of time;

- specifying a forum or venue where a consumer must bring a legal action in court;

- limiting the ability of the consumer to file a legal action seeking relief for other consumers or to seek to participate in a legal action filed by others;

- limiting liability to the consumer in a legal action including by capping the amount of recovery or type of remedy;

- waiving a cause of legal action by the consumer, including by stating a person is not responsible to the consumer for a harm or violation of law;

- limiting the ability of the consumer to make any written, oral, or pictorial review, assessment, complaint, or other similar analysis or statement concerning the offering provision of consumer financial products or services by the supervised registrant;

- waiving, whether by extinguishing or causing the consumer to relinquish or agree not to assert, any other identified consumer legal protection, including any specified right, defense, or protection afforded to the consumer under Constitutional law, a statute or regulation, or common law; and

- requiring that a consumer bring any type of legal action in arbitration.

Kristen E. Larson, John L. Culhane, Jr. & Alan S. Kaplinsky

U.S. Supreme Court Punts the NBA Preemption Analysis Back to the Second Circuit

On May 30, 2024, in a unanimous decision, the U.S. Supreme Court reversed Cantero v. Bank of America, N.A., and remanded it back to the Second Circuit and instructed the appellate court to analyze whether New York’s law requiring interest to be paid on mortgage escrow accounts is preempted under the Dodd-Frank Act by applying the Barnett Bank standard. No bright line test for preemption was articulated by the U.S. Supreme Court; instead, the U.S. Supreme Court relied on Barnett Bank and its earlier precedents dealing with National Bank Act (NBA) preemption.

The question before the U.S. Supreme Court was whether the NBA preempts application of that New York interest-on-escrow law to national banks. The district court determined that the New York law applied to national banks and was not preempted under federal law or the NBA. The Second Circuit reversed, holding that the New York law was preempted by the NBA. The Second Circuit held that federal law preempts any state law that “purports to exercise control over a federally granted banking power,” regardless of “the magnitude of its effects.” The Second Circuit concluded that the New York law was preempted because it exerted control over a national bank’s powers to fund escrow accounts.

The U.S. Supreme Court held that the Second Circuit failed to analyze whether New York’s interest-on-escrow law is preempted as applied to national banks in a manner consistent with Dodd-Frank and Barnett Bank. Section 1044 of Dodd Frank provides that a state consumer financial law is preempted if it would have a discriminatory impact on national banks as compared to banks chartered by the same state or if “in accordance with the legal standard for preemption in the decision of the U.S. Supreme Court of the United States in Barnett Bank…, the State consumer financial law prevents or significantly interferes with the exercise by a national bank of its powers.” 12 U.S.C. §25b (1)(B). Since the New York law does not discriminate against national banks, the law is preempted only if it “prevents or significantly interferes” with a national bank’s powers. The U.S. Supreme Court noted that “[g]iven Dodd-Frank’s direction to identify significant interference ‘in accordance with’ Barnett Bank, courts addressing preemption questions in this context must do as Barnett Bank did and likewise take account of those prior decisions of this court and similar precedents.”

The U.S. Supreme Court concluded that the Second Circuit “did not conduct that kind of nuanced comparative analysis” required under Barnett Bank and stated:

A court applying that Barnett Bank standard must make a practical assessment of the nature and degree of the interference caused by a state law. If the state law prevents or significantly interferes with the national bank’s exercise of its powers, the law is preempted. If the state law does not prevent or significantly interfere with the national bank’s exercise of its powers, the law is not preempted. In assessing the significance of a state law’s interference, courts may consider the interference caused by the state laws in Barnett Bank, Franklin, Anderson, and the other precedents on which Barnett Bank relied. If the state law’s interference with national bank powers is more akin to the interference in cases like Franklin, Fidelity, First National Bank of San Jose, and Barnett Bank itself, then the state law is preempted. If the state law’s interference with national bank powers is more akin to the interference in cases like Anderson, National Bank v. Commonwealth, and McClellan, then the state law is not preempted.

The cases where the state laws were found to be preempted under the NBA are:

- First National Bank of San Jose v. California, 262 U.S. 366, 369-70 (1923) (a California law allowed the state to claim deposits that went “unclaimed for more than twenty years” without requiring the account to be abandoned was preempted because it interfered with the “efficiency” of the national bank in receiving deposits);

- Franklin National Bank of Franklin Square v. New York, 347 U.S. 373, 378-379 (1954) (a New York law prohibiting banks from using the words “saving” or “savings” in advertising their business was preempted because it interfered with the national bank’s statutory power to receive savings deposits);

- Fidelity Federal Savings & Loan Association v. De la Cuesta, 458 U.S. 141, 155 (1982)(a California law limiting due-on-sale clauses was preempted because the savings and loan could not exercise a due-on-sale clause “solely at its option;” but case involved Federal Thrift and not NBA preemption of state laws which was field preemption); and

- Barnett Bank of Marion Cty., N. A. v. Nelson, 517 U.S. 25, 35-36 (1996) (a Florida law prohibiting banks from selling insurance was preempted because is significantly interfered with a bank’s power authorized by federal law to sell insurance).

The cases where the state laws were not found to be preempted are:

- Anderson National Bank v. Luckett, 321 U.S. 233, 249 (1944) (a Kentucky law that required banks to escheat abandoned property was not preempted because the law did “not infringe or interfere with any authorized function of the bank”);

- National Bank v. Commonwealth, 9 Wall. 353, 352-363 (1870) (a Kentucky law that taxed all bank shareholders on their shares of bank stock was not preempted because it did not hinder the bank’s operations); and

- McClellan v. Chipman, 164 U.S. 347, 358 (1896) (a generally applicable Massachusetts contract law was not preempted because it did not “in any way impai[r] the efficiency of national banks or frustrat[e] the purpose for which they were created”).

These cases that the U.S. Supreme Court suggests the Second Circuit use for comparative analysis are unlikely to be helpful in deciding on which side of the line the New York interest-on-escrow law falls.

The following statement from the opinion sums up the difficultly in preemption determinations going forward:

We appreciate the desire by both parties for a clearer preemption line one way or the other. But Congress expressly incorporated Barnett Bank into the U.S. Code. And in determining whether the Florida law at issue there was preempted, Barnett Bank did not draw a bright line.

Additionally, in a footnote at the end of the opinion, the U.S. Supreme Court indicated that the Second Circuit could consider the significance of any of the preemption rules adopted by the Office of Comptroller of the Currency (OCC) even though it implicitly rejected the preemption analyses previously done by the OCC, and whether, as provided in Section 1044(b)(1)(C) of Dodd Frank, any other federal law preempts the state consumer financial law (the district court found no preemption under TILA, RESPA, and Dodd-Frank). The Department of Justice criticized the OCC’s “different and broader view of NBA preemption” in its amicus brief. By way of background, shortly after the enactment of Dodd-Frank, the OCC promulgated a regulation saying that many categories of state laws were automatically preempted. The new post Dodd-Frank regulation was strikingly similar to the pre-Dodd-Frank regulation. Many, if not most, national banks reasonably relied on the OCC’s categorical preemption which the U.S. Supreme Court has now rejected.

Last December, Democratic Senators sent a letter to Acting Comptroller of the Currency Michael Hsu “to address [the OCC’s] longstanding expansion of its preemption authority to undermine state consumer protections.” The letter claimed that OCC has not followed the preemption authority requirement in Section 1044 of Dodd Frank and interfered with states exercising authority for non-preempted consumer protection laws.

We have previously expressed practical concerns with relying upon the OCC’s categorical preemption after the passage of Dodd-Frank. Under Dodd-Frank, an OCC preemption determination is no longer entitled to special Chevron deference and instead receives more limited Skidmore deference, whether or not the determination is made under the Barnett Bank standard and whether or not it addresses a “State consumer financial law.”

We expect a more liberal analysis from the Second Circuit than we have seen from the Fifth Circuit with limited deference to the OCC’s preemption determinations. With no bright line test, the Barnett Bank analysis as to whether a state law like New York’s interest on escrow accounts “prevents or significantly interferes” with a national bank’s powers could vary based on a bank’s asset size. Moreover, it would seem that a law preempted at one time may later cease to be preempted if the impact on the bank changes as a result of the bank’s growth or even as the result of technological innovations implemented by the bank. The practical implication of this is that preemption analysis by banks must be a (recurring) fact intensive exercise. We will monitor the Second Circuit’s decision and see whether the appellate court rules or kicks the case back to the district court.

The takeaway from this opinion is that national banks may have to take a fresh look at all potentially applicable state laws, not just those dealing with mortgage escrow accounts, with which they are not complying and determine, after conducting a thorough “significant impairment” analysis, whether they should change their positions. This is a time consuming and costly exercise, but one that may be necessary to avoid class action litigation.

Kristen E. Larson, John L. Culhane, Jr., Alan S. Kaplinsky, Joseph J. Schuster & Ronald K. Vaske

This Week’s Podcast Episode: Did the U.S. Supreme Court Hand the CFPB a Pyrrhic Victory?

Special guest Professor Hal Scott of Harvard Law School joins us today as we delve into the thought-provoking question of whether the U.S. Supreme Court’s recent decision in the landmark case of CFSA v. CFPB really hands the CFPB a winning outcome, or does the U.S. Supreme Court’s validation of the agency’s statutory funding structure simply open up another question: whether the CFPB is legally permitted to receive funds from the Federal Reserve if (as now) the Fed has no earnings. In other words, was the outcome in CFSA v. CFPB an illusory Pyrrhic victory for the CFPB? And, what happens next?

Our episode begins with a brief discussion of the underlying case. Professor Scott follows with an explanation of the CFPB’s statutory funding mechanism as established by the Dodd-Frank Act, which provides that the CFPB is to receive its funding out of the Federal Reserve System’s “earnings”, and the U.S. Supreme Court’s decision upholding that structure.

Then, we turn to an in-depth discussion of the op-ed Professor Scott published in the Wall Street Journal entitled “The CFPB’s Pyrrhic Victory in the U.S. Supreme Court”, in which Professor Scott explains that even though the CFPB’s funding mechanism as written was upheld in CFSA v. CFPB, this will not help the agency now or at any time in the future when the Federal Reserve operates at a deficit – in fact, has no earnings it can legally send to the CFPB. Professor Scott describes how his focus on the Federal Reserve led him to scrutinize and then question the approach taken in the majority opinion; and then turns to an explanation of how a constitutional issue under the Appropriations Clause in fact may persist because in the absence of Fed earnings, funds paid to the CFPB arguably have not been drawn from the Treasury. We then go over possible arguments challenging the CFPB’s issuance and enforcement of regulations, and what might ensue when the federal district court takes up CFSA v. CFPB for further proceedings.

Former practice leader and current Senior Counsel in Ballard Spahr’s Consumer Financial Services Group, Alan Kaplinsky, hosts this week’s episode.

To listen to this episode, click here.

Our blogs about the U.S. Supreme Court decision in CFSA v. CFPB can be found here and here.

To read our blog about Professor Scott’s op-ed in the Wall Street Journal, which includes a link to the op-ed, click here.

CFPB Alleges Dark Patterns in Suit Against Fintech Peer-to-Peer Lender

On May 17, 2024, the Consumer Financial Protection Bureau (CFPB) filed suit against an online lending platform, alleging, among other things, the use of dark patterns to induce consumers to pay tips and donations, disclosure violations, and usury violations on loans offered through its lending platform. The complaint, filed in the U.S. District Court for the Central District of California, accuses the company of misrepresenting the cost of loans, tricking consumers into believing that a donation is required to obtain a loan, making false threats, collecting money that consumers do not actually owe, and failing to ensure that data the company uses for credit decisions is accurate. The CFPB seeks injunctive relief, consumer redress, disgorgement, and a civil money penalty.

According to the complaint, the company targeted by the action markets its online lending platform to borrowers as a consumer-friendly alternative to high-cost, short-term loans. Advertisements and disclosures state that the loans are “no interest,” “0% APR,” or “0% interest.” Consumers may serve as individual peer lenders and profit from tips received on loans that they fund. In addition to tipping the peer-lender, borrowers have the option of paying a donation to the company for facilitating the loan. The company’s website states that all tips and donations are optional and voluntary, but the CFPB alleges that such fees are not optional because virtually all consumers who receive loans pay a tip, a donation, or both. The tip-based model has become increasingly popular in small dollar lending, earned wage access, and other fintech lending as an alternative to more traditional interest and fee-based models.

More specifically, the CFPB alleges:

- Deceptive Practices and Dark Patterns Related to Tips and Donations: According to the complaint, borrowers are prompted during the application process to select a tip amount and encouraged to pay the “maximum possible tip” to increase the likelihood that the loan is funded. Additionally, the CFPB asserts that borrowers are prompted to select one of three default donation amounts based on a percentage of the loan principal, and that it does not provide a “No Donation” or “0%” option or a way to click through to the next page without selecting a donation amount. While there is a way to receive a loan without a tip or donation, the CFPB maintains that the option is obscured — it is not disclosed and involves toggling off the “Donation” setting at the end of a list of other options on a separate “Settings” screen outside of the application flow.

- Misleading Advertisements and Disclosures: The CFPB alleges that marketing “no interest” loans fails to account for the tip and donation and is deceptive. While the complaint does not include a cause of action for a violation of the Truth in Lending Act, the CFPB alleges the failure to include the tip and donation amounts in the finance charge, APR, and total of payments is a deceptive practice under the Consumer Financial Protection Act.

- Violations of Licensing and Usury Laws: The CFPB contends that the company serviced and collected (or attempted to collect) loans that were void and uncollectible under the laws of a number of states, because either the company was not licensed to make such loans or the loans exceeded the state usury cap. According to the Bureau, the company did not have–a license to lend, broker, arrange, or provide credit services in sixteen states. It further alleges that almost all of the company’s loans – which range in size between $20 and $575 – carry an annual percentage rate of over 36% (the interest rate cap for certain consumer loans in several states as well as under the Military Lending Act), with many in excess of 300%, above many state usury limits.

- Failure to Maintain Reasonable Procedures to Ensure the Accuracy of Credit Information: The CFPB alleges that the company is a credit reporting agency under the Fair Credit Reporting Act. The complaint states that the company gathered credit information about applicants – including information about their cell phones, deposit accounts, debit cards, and prior loans made by the company – to create a proprietary score that was provided to third-party prospective lenders reviewing a loan request. The Bureau alleges that the company failed to maintain reasonable procedures, as required under Section 607(b) of FCRA, 15 U.S.C. § 1681e(b), to ensure the accuracy of the information it shared with lenders. This included a failure to verify whether the score reflected all loans that had been repaid on the company’s platform, whether fraud or lender account problems resulted in a borrower appearing to be overdue on a loan they had actually repaid, and whether the number of repaid loans included in the score was accurate.

- Misrepresentations Regarding Collections: The CFPB alleges that the company attempted to coerce payment on loans obtained through the platform by misrepresenting that if a consumer failed to repay the loan it would be reported to credit reporting agencies (CRAs) and impact the consumer’s credit score, when in fact the company did not report any of its loans to the CRAs.

The CFPB notes in its press release that the company has entered into settlements related to these practices in California, Washington, D.C. and Connecticut. We previously discussed those three settlements, in which the fintech did not admit to any violations of law or wrongdoing, here.

Michael R. Guerrero & Brian Turetsky

California’s DFPI Releases Third Annual Report on Activity Under the CCFPL

On April 25, 2024, California’s Department of Financial Protection and Innovation (DFPI) released its Annual Report of Activity Under the California Consumer Financial Protection Law for 2023 (“Annual Report”). The Annual Report provides an overview of rulemaking, enforcement, oversight, consumer complaints, education, and outreach for the calendar year 2023 and confirms that 2023 was the most active year yet for the DFPI. In addition to advancing two significant rulemaking packages under the California Consumer Financial Protection Law (CCFPL), the DFPI dramatically increased its number of investigations and public actions related to the CCFPL. The DFPI also received 70% more CCFPL-related complaints than it received last year and implemented a new consumer complaints portal to capture those complaints.

The first of the two rulemaking packages advanced under the CCFPL is the rule empowering the DFPI to pursue unlawful, unfair, deceptive, or abusive acts and practices (referred to in the Annual Report as UUDAAP) against providers of commercial financing or other financial products or services to small businesses. This rule became effective on October 1, 2023 and also requires annual reporting from providers of small business financing.

The second rule would require registration and reporting from providers of what the Annual Report refers to as “four previously unregistered products and services in California:

- (1) income-based advances, including ‘earned wage access’ (EWA) products;

- (2) private postsecondary education financing;

- (3) debt settlement, and

- (4) student debt relief.”

The rule’s registration requirements are robust, and the rule would also deem earned wage access products to be loans and any optional charges, including tips, to be charges under the California Financing Law. This second rule has been stalled by the Office of Administrative Law’s Disapproval Decision for a lack of clarity and a failure to follow the required rulemaking procedure.

The Annual Report also highlights three pieces of legislation chaptered in 2023 that supplement the CCFPL by establishing licensing requirements and standards for specific products and industries:

- AB 39, which will require licensing beginning July 1, 2025 for any person engaging in crypto asset business activity of more than $50,000 annually with or on behalf of a California resident;

- SB 301, which requires the DFPI to regulate crypto kiosks with withdrawal limits, mandatory disclosures, and fee caps; and

- SB 478, which makes it an unlawful business practice to advertise a price for a good or service that does not include all mandatory fees or charges.

The DFPI increased the number of CCFPL-related investigations from 196 in 2022 to 734 in 2023 and the number of public CCFPL-related actions from 94 in 2022 to 181 in 2023. The Annual Report shows that more than two-thirds of the investigations and actions taken involve crypto scams and investigations. The other categories mentioned are “fake debt collectors,” private postsecondary education financing, and student debt relief companies. The Annual Report also mentions the DFPI’s ongoing true lender litigation against Opportunity Financial, LLC in which the DFPI suffered a significant setback in late 2023.

The Annual Report also discusses the activities of the Consumer Financial Protection Division, the Office of Financial Technology Innovation, and the Office of Public Affairs, which collectively demonstrate the delicate balance that the DFPI is trying to strike between protecting consumers and promoting responsible innovation. We will continue to monitor the DFPI’s activities under the CCFPL and expect that 2024 will be an even more active year for the department.

John A. Kimble & Michael R. Guerrero

Colorado Rate Exportation Litigation: Motion to Dismiss Complaint Claims There Is No Claim There

Last month, just a few days before the preliminary injunction hearing, Colorado’s attorney general filed a Motion to Dismiss the Complaint filed in federal district court in Colorado by three financial services industry trade groups challenging Colorado’s statute purporting to opt out (slated to take effect July 1, 2024) of a federal law that permits FDIC-insured state-chartered banks to “export” interest rates on interstate loans. Pursuant to Section 521 of the Depository Institutions Deregulation and Monetary Control Act of 1980 (DIDMCA), an FDIC-insured, state-chartered bank has the power to “export” the interest rates authorized in the state where the bank is located to borrowers in other states. Section 525 of DIDMCA allows states to enact laws opting out of Section 521’s preemptive effect with respect to loans “made in” the enacting state. The issue before the court in Colorado is where a loan is “made” in the case of loans to Colorado residents by insured state banks located in other states.

In support of its assertion that the plaintiffs’ complaint must be dismissed, Colorado first argues “Federal law expressly permits states to opt out of [DIDMCA] so their interest rate laws will not be preempted by state-chartered banks. . . Plaintiffs seek to deny Colorado the choice expressly provided by federal law. Their claims should be dismissed.”

The Motion to Dismiss proceeds with further arguments, including:

- The plaintiffs’ allegation that Colorado’s opt-out violates the Supremacy Clause of the U.S. Constitution fails to state a claim because “there is no conflict” between the Colorado opt-out and federal law “as a matter of law,” since “plaintiffs have failed to allege that Colorado’s Opt-Out exceeded the authority granted in Section 525 or that there is a conflict between state and federal law,” and because in fact Colorado’s opt-out does not exceed that authority or conflict with Section 525;

- The Supremacy Clause does not create a cause of action permitting the plaintiffs to sue for injunctive relief, and no challenge is available to plaintiffs under the Federal Deposit Insurance Act;

- Plaintiffs’ Dormant Commerce Clause argument fails because Congress authorized Colorado’s opt-out, and because the plaintiffs did not plead facts “identifying a law that discriminates against interstate commerce;” and

- Plaintiffs lack standing because “plaintiffs’ injury is based on a misconstruction of Section 525.”

The plaintiffs’ Motion for Preliminary Injunction, which was the subject of a court hearing on May 16, remains pending. It is interesting to note that in its Motion to Dismiss, Colorado also takes the opportunity to counter arguments made in both the amicus brief filed by the ABA and CBA supporting the plaintiffs’ Motion for Preliminary Injunction, and the plaintiffs’ Reply to Colorado’s Response to the Motion for Preliminary Injunction. For example, in refuting violation of the Supremacy Clause, the Motion to Dismiss asserts that “the plain text and structure” of DIDMCA supports Colorado’s argument that loans are “made” in the state where the borrower is located, a position also adopted by the FDIC in its amicus brief unexpectedly filed in support of Colorado’s opt-out.

Indeed, it appears that the defendants’ main reason for filing their Motion to Dismiss when they did was to respond to the plaintiffs’ reply brief and the ABA/CBA amicus brief submitted in connection with the plaintiffs’ motion for preliminary injunction.

The parties have stipulated to extend the plaintiffs’ time to respond to Colorado’s Motion to Dismiss until June 24, 2024.

Mindy Harris & Alan S. Kaplinsky

New EEOC Pregnant Workers Rule Adds Requirements This Month

The U.S. Equal Opportunity Commission has issued its final regulations for the Pregnant Workers Fairness Act (PWFA), providing guidance for employers on implementing the PWFA in their workplaces and understanding how the law will be enforced. The new rules will take effect on June 18, 2024, although the PWFA itself has been in effect since June 27, 2023.

The PWFA provides expanded workplace protections for employees with conditions related to pregnancy or childbirth. While many of its concepts are similar to the requirements of the Americans with Disabilities Act, the PWFA and its accompanying regulations mandate broader protections in several important respects.

Read our full Alert on the final regulations here.

Employers will want to take steps to ensure compliance with the final regulations and interpretive guidance by June 18, 2024. Ballard Spahr’s Labor and Employment Group has significant experience helping employers navigate regulatory compliance issues related to pregnancy and lactation, including advising on employment policies, providing training that helps avoid future issues, and defending against claims should they arise.

Last week, the CFPB issued its Semi-Annual Report to Congress covering the period beginning April 1, 2023 and ending September 30, 2023.

On June 12, 2024, CFPB Director Chopra is scheduled to appear before the Senate Banking Committee for a hearing, “The Consumer Financial Protection Bureau’s Semi-Annual Report to Congress.” On June 13, 2024, he is scheduled to appear before the House Financial Services Committee for a hearing, “The Semi-Annual Report of the Bureau of Consumer Financial Protection.”

FinCEN Releases Year-in-Review for FY 2023: SARs, CTRs, and Information Sharing

The Financial Crimes Enforcement Network (FinCEN) has issued its Year in Review for FY 2023 (YIR). It consists of five pages of infographics. According to FinCEN’s press release:

The Year in Review is intended to help stakeholders gain insight into the collection and use of Bank Secrecy Act [(BSA)] data, including FinCEN’s efforts to support law enforcement and national security agencies. The Year in Review includes statistics from fiscal year 2023 on BSA reporting and how it is queried and used by law enforcement agencies. The Year in Review also includes information on how FinCEN uses and analyzes BSA reporting to fulfill its mission, including to support alerts, trend analyses, and regulatory actions. The publication of the Year in Review is in furtherance of FinCEN’s commitment to provide information and statistics on the usefulness of BSA reporting, consistent with Section 6201 of the Anti-Money Laundering Act of 2020.

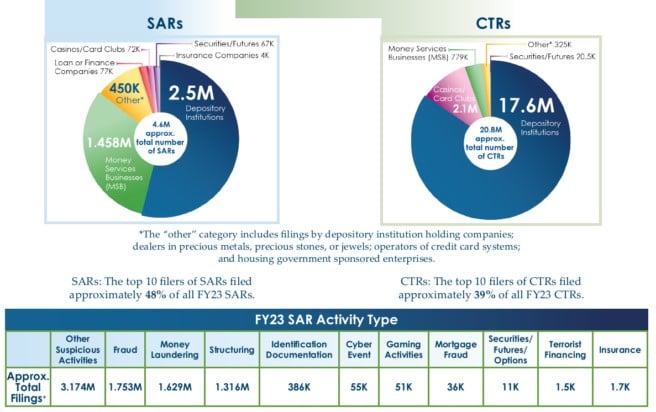

According to the YIR, there are approximately 294,000 financial institutions and other e-filers registered to file BSA reports with FinCEN. Collectively, they filed during FY 2023 a total of 4.6 million Suspicious Activity Reports (SARs) and 20.8 million Currency Transaction Reports (CTRs), as well as 1.6 million Reports of Foreign Bank and Financial Accounts (FBARs), 421,500 Forms 8300 regarding cash payments over $10,000 received in a trade or business, and 143,200 Reports of International Transportation of Currency or Monetary Instruments (CMIRs) for certain cross-border transactions exceeding $10,000.

As we will discuss, a massive amount of SARs and CTRs are filed every year. Apparently – and the YIR necessarily represents only a snapshot lacking full context, so extrapolation is dangerous – only a very small portion of those filings ever become relevant to actual federal criminal investigations. Further, the YIR suggests that information sharing under Section 314 of the Patriot Act between the government and financial institutions remains an under-utilized tool.

SARs and CTRs

The below infographic sets forth the sources of the SARs and CTRs, and the types of suspicious activities referenced in the SARs. Naturally, depository institutions file more reports than any other type of financial institutions, although money service businesses – which include cryptocurrency exchanges – are not far behind in regard to the number of their SAR filings.

The volume of SARs filed every year continues to climb, thereby keeping the spotlight on the question of the actual effectiveness and usefulness of SARs, particularly given their numbers and the phenomenon of “defensive filing” by financial institutions. The YIR confirms that the primary law enforcement “consumer” of SARs is the Internal Revenue Service – Criminal Investigation (IRS – CI), which has reported that 85.7% of investigations recommended for prosecution during FYs 2021 to 2023 “have a primary subject with a related BSA filing” (the IRS-CI Report for 2023 stated that IRS-CI recommended for prosecution 665 tax-crime matters and 1,179 non-tax crime matters, for a total of 1,838 matters referred in FY 2023, therefore suggesting that approximately 1,575 cases referred for prosecution involved BSA filings).

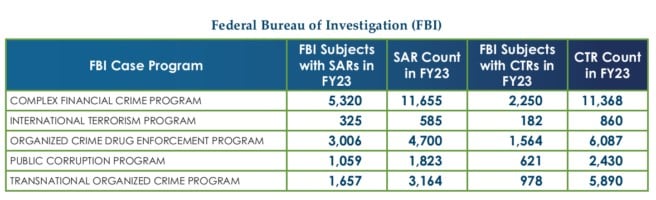

More importantly, IRS-CI reported that 13.9% of all investigations opened in FY 2023 originated from BSA data – as opposed to just involving the access of BSA data after opening (the IRS-CI Report for 2023 stated that IRS-CI opened 1,409 tax-crime related investigations and 1,267 non-tax crime related investigations, for a total of 2,676 investigations opened in FY 2023, therefore suggesting that IRS-CI opened about 372 investigations as a result of BSA filings). The following graphic sets forth use of BSA data by the FBI:

Thus, 11,367 FBI investigative subjects were also the subjects of SARs in FY 2023. Further, the YIR states that approximately 15.42% of active FBI investigations were “directly linked” to SARs and CTRs. However, and unlike with regard to IRS-CI, the YIR does not indicate how many FBI investigations were opened as a result of BSA data, and it is impossible to tell from the YIR what exact role, if any, BSA data played in FBI investigations, beyond the fact that certain investigatory subjects also were named in SARs and CTRs.

This data indicates that, compared to the approximately 4.6 million SARs filed in FY 2023, there were approximately 13,000 cases involving either IRS-CI or the FBI with some connection to SARs. Although this comparison is likely imperfect, and although there are other law enforcement agencies which also accessed SARs, the combined amount of IRS-CI and FBI cases involving SARs in some way appears to represent less than 0.3% of all FY 2023 SARs.

Section 314 Information Sharing: An Underused Tool?

Finally, the YIR sets forth some data points on Section 314 information sharing between the government and financial institutions (Section 314(a)), and amongst financial institutions (Section 314(b)). Both forms of information sharing are potentially powerful yet often under-utilized tools for combatting illicit finance and hampering criminal schemes in real time.

The YIR notes that approximately 14,000 financial institutions participate in Section 314(a) information sharing, which in FY 2023 involved 588 requests from 71 different law enforcement agencies regarding 4,606 subjects, which elicited 55,400 responses.

As for Section 314(b) sharing among financial institutions, the YIR indicates that 7,790 financial institutions have registered to participate. This number is just a small fraction of the 294,000 financial institutions and other e-filers registered to file BSA reports with FinCEN. Most of those registered are banks or credit unions (4,458), followed by investment advisers or other entities involved in the securities/futures industry (1,770). Over 26,400 SARs – filed by over 1,300 financial institutions – referenced Section 314(b), which potentially gives some insight into the use, or lack thereof, of Section 314(b) by financial institutions.

If you would like to remain updated on these issues, please click here to subscribe to Money Laundering Watch. Please click here to find out about Ballard Spahr’s Anti-Money Laundering Team.

On May 20, 2004, the Federal Trade Commission (FTC) sent its annual report to the Consumer Financial Protection Bureau (CFPB) highlighting its enforcement actions and initiatives in 2023 under the Truth in Lending Act (TILA), Consumer Leasing Act (CLA), and Electronic Fund Transfer Act (EFTA).

While the Dodd-Frank Act (“Dodd-Frank”) provided the CFPB with rulemaking and enforcement authority over the major consumer financial services laws and regulations, the FTC retained authority to enforce TILA and Regulation Z, CLA and Regulation M, EFTA and Regulation E, and CFPB rules applicable to entities within the FTC’s jurisdiction. The FTC exercises this authority over non-bank financial service providers in accordance with Dodd-Frank and coordinates its regulatory efforts pursuant to a memorandum of understanding with the CFPB signed in 2012 and reauthorized in 2015 and 2019. The annual report includes sections for each statute discussing enforcement actions; rulemaking, research, and policy development; and consumer and business education for each regulation.

The most prominent items in the report for 2023 involved the following rulemaking developments:

- CARS Rule: The FTC announced the Combating Auto Retail Scams Rule (“CARS Rule”) in December 2023, which sets new requirements on the sale, financing, and leasing of new and used vehicles by motor vehicle dealers. It prohibits certain misrepresentations in the financing process, sets disclosure requirements on dealers’ advertising and sales communications, mandates that dealers obtain consumers’ express, informed consent for charges, and prohibits the sale of add-on products or services if there is no benefit to the consumer. (The final rule is not yet effective, as it was stayed by the FTC after a petition was filed seeking review in the U.S. Court of Appeals for the Fifth Circuit.)

- Junk Fees: In October 2023, the FTC issued a proposed rule, “Rule on Unfair or Deceptive Fees,” to address “junk fees,” fees that the Commission deems to be unfair or deceptive fees because they are for goods or services that have little or no added value to a consumer. The proposed rule sets requirements on the offering, displaying, or advertising of amounts a consumer may pay, requiring the total price to be clearly and conspicuously disclosed. It also prohibits misrepresenting the nature and purpose of any amount a consumer may pay, including the refundability of such fees and the identity of any good or service for which fees are charged.

- Negative Options: The FTC issued a proposed rule amending the Negative Option Rule in March 2023. The proposed amendments, which would expand the scope of the rule’s coverage to all forms of negative option marketing and consolidate various requirements dispersed across various statutes and regulations, include a “click to cancel” provision which would require a simple mechanism for consumers to easily cancel subscriptions by using the same method they used to initially enroll.

Notable enforcement actions included:

- Traffic Jam Events: The FTC noted that litigation continued at the appellate level against Traffic Jam Events, LLC over a 2021 administrative opinion and order that banned the company from doing business after concluding that it engaged in deceptive practices under the FTC Act and violated TILA. The alleged violations stem from the company sending mailers to consumers suggesting the company was affiliated with a government COVID-19 stimulus program, advertisements sent to consumers stating that they had won specific valuable prizes that they had not actually won, and quoting monthly payments by mail that failed to provide or hid key financing terms in the fine print. Traffic Jam Events filed a petition for review of the FTC’s order in December 2021, and oral argument took place in May 2023.

Notable reports and task forces included:

- Report on Consumer Issues Affecting American Indian and Alaska Native Communities: On March 15, 2023, the FTC issued a report to Congress detailing consumer issues that affect American Indian and Alaska Native (AI/AN) populations and its enforcement, outreach and education work on issues such as auto finance and predatory lending. The report includes a discussion of scams affecting AI/AN populations, casework related to auto buying and financing issues and predatory lending, among other issues, and recommendations including continued efforts to fight against fraud and scams through enforcement

- FTC Military Task Force: In 2023, the FTC’s Military Task Force continued its work on military consumer protection issues, including coordination with the American Bar Association’s Standing Committee on Legal Assistance for Military Personnel and the Department of Defense Military Lending Task Force on issues including the Military Lending Act, automobile financing and leasing issues, and EFTA issues.

- Protecting Older Consumers Report: On October 18, 2023, the FTC released a report, “Protecting Older Consumers 2022-2023: A Report of the Federal Trade Commission,” discussing trends based on fraud reports by older adults and the Commission’s efforts to combat the problem. According to the report, older adults (aged 60 and over) reported losing more than $1.6 billion to fraud in 2022 and were substantially less likely to report fraud incidents than younger consumers.

In addition to the rulemaking, enforcement actions, and reports and task forces discussed above, the FTC also highlighted its consumer and business education efforts. Much of the FTC’s education initiatives involved promotional campaigns around its rulemaking, but also included articles published in 2023 on auto trade-ins and negative equity, mortgage assistance programs, payday and title loans, and risks associated with payment applications and wire transfers.

Brian Turetsky, John L. Culhane, Jr. & Michael R. Guerrero

Credit Card and Other Rewards Programs in the Crosshairs

A Ballard Spahr Webinar | June 20, 2024, 2:00 PM – 3:00 PM ET

Moderator: Alan S. Kaplinsky; Michael R. Guerrero; Joseph Schuster; Kristen Larson

MBA Human Resources Symposium 2024

September 18-19, 2024 | MBA Headquarters, Washington, D.C.

Fair Labor Standards Act and 2024: New Rules, New Headaches

September 18, 2024 – 9:15 AM ET

Speaker: Meredith S. Dante

The Loan Originator Compensation and Other Regulatory and Legal Developments

September 18, 2024 – 1:00 PM ET

Speaker: Richard J. Andreano, Jr.

Subscribe to Ballard Spahr Mailing Lists

Copyright © 2026 by Ballard Spahr LLP.

www.ballardspahr.com

(No claim to original U.S. government material.)

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, including electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the author and publisher.

This alert is a periodic publication of Ballard Spahr LLP and is intended to notify recipients of new developments in the law. It should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own attorney concerning your situation and specific legal questions you have.