February 1, 2024 – Read the below newsletter for the latest Mortgage Banking and Consumer Finance industry news written by Ballard Spahr attorneys. In this issue we discuss the Supreme Court’s hearing oral arguments in two cases related to Chevron, as well as the Federal Reserve Board’s proposal to lower interchange fee cap for debit card transactions.

In This Issue:

- SCOTUS Holds Oral Argument in Two Cases Challenging Chevron Deference; Ballard Spahr to Host Special Webinar Roundtable on February 15

- SCOTUS to Hear Oral Argument on February 27 in National Bank Act Preemption Case

- Bank of America Files Merits Brief With SCOTUS in National Bank Act Preemption Case; DOJ Seeks Leave to Participate in Oral Argument

- This Week’s Podcast Episode: Understanding the Federal Reserve Board Proposal to Lower Interchange Fee Cap for Debit Card Transactions

- New Research Suggests Proposed Regulation II Revisions Lowering Debit Card Interchange Fees Will Cost Consumers up to $2 Billion Annually

- Ballard Spahr to Hold February 28 Webinar on FTC Developments

- DOJ Settles with Patriot Bank for Redlining in Memphis

- CFPB Proposes Rule to Ban “Rarely Charged” NSF Fees for Declined Transactions Based on Wildly Expansive View of “Abusive” Prong

- FinCEN Analysis Reveals $212 Billion in Identity-Related Suspicious Activity

- FHFA Again Addresses Underutilization of Appraisal Time Adjustments

- House Financial Services Committee Announces AI Working Group

- House Tax Bill Would Greatly Accelerate Employee Retention Credit Filing Deadlines

- HR 7024: Low-Income Housing Legislation on the Move

- Looking Ahead

On January 17, 2024, the U.S. Supreme Court heard oral argument in the two cases in which the question presented is whether the Court should overrule its 1984 decision in Chevron, U.S.A., Inc. v. Nat. Res. Def. Council, Inc. That decision established what became known as “Chevron deference,” which requires courts to accept an agency’s interpretation of federal law if indicated by the outcome of a two-step analysis set forth in the decision. In step one, the court looks at whether the statute directly addresses the precise question before the court. If the statute is silent or ambiguous, the court will proceed to step two and determine whether the agency’s interpretation is reasonable. If it determines the interpretation is reasonable, Chevron instructs the court to defer to the agency’s interpretation.

The two cases before the Supreme Court are Loper Bright Enterprises v. Raimondo and Relentless, Inc. v. U.S. Department of Commerce. Both cases involve a regulation of the National Marine Fisheries Service (NMFS) that requires certain vessels to pay the salaries of the federal observers that they are required to carry. The regulation implements the Magnuson-Stevens Act (MSA) which authorizes the NMFS to require fishing vessels to carry federal observers. In both cases, the petitioners are owners of fishing vessels who challenged the NMFS regulation as exceeding the agency’s authority under the MSA. The district court in each case, applying Chevron deference, upheld the NMFS regulation. In Loper, a divided D.C. Circuit panel affirmed the district court and in Relentless, a unanimous First Circuit panel affirmed the district court.

With the exception of Justice Jackson, all of the Justices participated in oral argument in both cases. Justice Jackson recused herself from Loper because it arose out of the D.C. Circuit, on which she previously served before becoming a Supreme Court Justice. Solicitor General Elizabeth Prelogar argued on behalf of the government in both cases. In Relentless, Roman Martinez, a former Assistant Solicitor General and law clerk to Chief Justice Roberts and to Justice Kavanaugh when he served on the D.C. Circuit, argued on behalf of the owners of the shipping vessels. In Loper, Paul Clement, a former Solicitor General and law clerk to Justice Scalia, argued on behalf of the owners of the shipping vessels. In total, the Supreme Court heard approximately 3.5 hours of oral argument. The recording of the oral argument and transcript in Relentless are available, respectively, here and here. The recording of the oral argument and transcript in Loper are available, respectively, here and here.

The principal arguments advanced for overruling Chevron by Mssrs. Martinez and Clement on behalf of the owners of the shipping vessels were:

- Chevron violates Article III of the Constitution which vests the judicial power exclusively in the federal courts. Inherent in this judicial power is the duty of federal judges to apply their best and own independent judgment when determining what a federal statute means. Chevron undermines that duty by reallocating interpretive authority from courts to agencies, and forcing courts to give up their interpretive authority and defer to agency interpretations that are not persuasive or the “best” interpretations. Chevron rests on a fictional implied delegation of interpretive authority to agencies in the case of ambiguity or silence.

- Chevron violates the requirement in Section 706 of the Administrative Procedures Act (APA) that “the reviewing court shall decide all relevant questions of law, interpret constitutional and statutory provisions, and determine the meaning and applicability of the terms of an agency action.” This requirement mandates the court’s de novo review of legal questions.

The principal arguments advanced for not overruling Chevron by General Prelogar on behalf of the government were:

- Article III does not require de novo review of all statutory interpretation questions. There is no constitutional distinction between an express delegation of authority to an agency to define statutory terms and fill in gaps and the presumed or implicit delegation of authority recognized in Chevron.

- Section 706 of the APA is not incompatible or inconsistent with the two-step Chevron analysis because Section 706 does not require a universal standard of review to govern statutory interpretation questions. Courts are interpreting statutes when they apply the Chevron analysis. In step one, the court uses the standard tools of interpretation to determine whether Congress has spoken to the issue at hand. If so, Chevron requires nothing further and the court has interpreted the statute. If, at the end of that process, the court cannot determine whether Congress has spoken, the proper interpretation of the statute is that Congress left a gap or created an ambiguity and simultaneously vested the relevant agency with the responsibility to administer the statute with regulations that have the force of law.

In responding to questions from the Justices, Mssrs. Martinez and Clement presented starkly different views from those presented by General Prelogar about Chevron’s impact on reliance interests as well as the impact of a decision by the Supreme Court overruling Chevron.

According to Mssrs. Martinez and Clement:

- Chevron is a “reliance-destroying doctrine” because it “facilitates agency to flip-flopping.” “[I]nstead of a regulated entity being able to rely on the best interpretation of the law,” it must “check the C.F.R. every couple years to see if the law has somehow changed, even though Congress hasn’t acted.”

- A decision overruling Chevron would not invite a flood of litigation seeking to overturn cases in which a court deferred to an agency based on step two of the Chevron analysis. Since the bottom line holding in those cases was that the agency’s action was lawful, it would be difficult to overturn those cases under principles of stare decisis.

According to General Prelogar:

- Chevron promotes national uniformity by dampening ideological divisions between courts through their application of uniform agency rules. “[In] the alternative world where’s there is no Chevron…there will open up wide disputes among the lower courts…and I think it could mean that regulated parties are subject to different rules in different parts of the country.”

- Although the Supreme Court has not applied Chevron in recent years, there is “real world” reliance on Chevron. Congress, agencies, states, regulated entities, and the public have all relied on Chevron and the regulations upheld under Chevron to make important decisions that could be upended by overruling Chevron. This is because thousands of judicial decisions sustaining an agency’s rulemaking as reasonable would be open to challenge. Individuals have made investment decisions on the basis of agency regulations “that have been on the books for decades” and have also made decisions regarding what contracts to enter into on the basis of such regulations. The disruption that would result from overruling Chevron is unwarranted because Congress could modify or overrule the Chevron analysis at any time and has considered, but never acted on, proposals to modify Chevron. Instead, Congress has legislated for decades with Chevron as the background rule informing the amount of discretion that Congress has chosen to confer on federal agencies.

General Prelogar raised the possibility that rather than overrule Chevron, the Court could provide more guidance to lower courts on how to conduct a Chevron step one analysis. Justice Barrett referred to this as a suggestion that the Court “‘Kisorize’ Chevron.” “Kisorize” refers to the Supreme Court’s 2019 decision in Kisor v. Wilkie in which the court clarified how lower courts should apply Auer deference. Auer is the Supreme Court’s 1997 decision in Auer v. Robbins in which the Court established a framework for when courts must defer to an agency’s interpretation of its own regulations. Rather than overrule Auer, the Supreme Court, in Kisor, provided a more rigorous analysis that a court must conduct before deferring to an agency’s interpretation.

In response to Justice Kagan’s question asking her what it would mean to “Kisorize” Chevron, General Prelogar indicated that there are four steps the Court could take consisting of:

- Reemphasizing the “rigor” of the Chevron step one analysis (i.e. a court should not “waive the ambiguity flag too readily.”)

- Reinforcing that reasonableness “is not just anything goes.” A court should enforce any outer boundaries in the statute and make sure the agency has not transgressed them.

- Emphasizing that a Chevron analysis only applies in situations where an agency has been directly empowered by Congress “to speak with the force of law” and is “then exercising appropriately a formal level of authority in implementing the statute.”

- Emphasizing the importance of “look[ing] at any other statutory indication that Chevron deference was not meant to apply.” This would include situations “where the nature of the statutory question as the Court has said in other cases isn’t one where you would expect Congress to give that to the agency.” (General Prelogar stated that “there’s a flavor of this in the major questions doctrine case.”)

General Prelogar also indicated that where an agency has changed its interpretation, it would be under additional burdens to justify its rulemaking and would get “a harder look.”

Of the nine Justices, Justices Kavanaugh, Gorsuch, and Alito appeared to be the most overtly in favor of overruling Chevron, with their questions and comments appearing primarily designed to highlight what they perceive to be Chevron’s flaws, particularly the lack of a clear definition for what constitutes an “ambiguity” that would trigger step two of a Chevron analysis (termed the “ambiguous ambiguity trigger” by Justice Gorsuch). Justices Kagan, Sotomayor, and Jackson appeared to be clearly in favor of a decision that did not overrule Chevron, with their questions appearing primarily designed to highlight what they perceive to be Chevron’s appropriate recognition of the limits of judicial expertise and the value of agency expertise in resolving questions of statutory interpretation as well as Chevron’s role in insulating courts from the need to make policy decisions. Chief Justice Roberts and Justices Barrett and Thomas were less revealing of their positions, with their questions and comments appearing primarily designed to probe the limits on delegation of judicial authority and how the Chevron analysis would apply in different scenarios. Justice Barrett (like Justices Kagan and Sotomayor) also probed the impact of overruling Chevron on cases that have been decided by courts based on step two of the Chevron analysis (i.e., cases in which the court deferred to an agency rule).

The Court will issue decisions in both cases before the end of its term in June 2024. We cannot readily predict based on the oral arguments that a majority of the Court will vote to overrule Chevron. However, we do not expect Chevron to survive unscathed. Rather, we expect that if the Court does not overrule Chevron, it will effectively create a new framework for Chevron deference that requires a more rigorous analysis in Chevron step one with the goal of significantly limiting the circumstances in which a court can defer to an agency’s interpretation.

On February 15, 2024, we will host a special webinar roundtable featuring Professor Kent Barnett, two other renowned administrative law professors and Carter Phillips, a leading Supreme Court practitioner, who will share their observations and reactions to the Loper and Relentless oral arguments, insights based on questions posed by the Supreme Court justices during the arguments, and further predictions of the outcome and implications for the future of regulatory regimes and agency authority. For more information and to register for the webinar, click here.

SCOTUS to Hear Oral Argument on February 27 in National Bank Act Preemption Case

On February 27, 2024, the U.S. Supreme Court will hear oral argument in Cantero v. Bank of America, N.A., a case involving the scope of preemption under the National Bank Act (NBA). The question before the Court is whether the NBA preempts a New York statute requiring banks to pay interest on mortgage escrow accounts. Reversing the district court, the Second Circuit ruled that the application of the New York statute to national banks is preempted by the NBA.

Since the OCC finalized its preemption regulations, most national banks have relied on them to not comply with many state consumer protection laws. A ruling by the Supreme Court in Cantero that the NBA does not preempt the New York law will implicitly call into the question the validity of the OCC’s preemption regulations and mean that national banks will have to take a fresh look at whether they must now comply with certain state consumer protection laws and regulations which they have been ignoring. An adverse ruling in Cantero could also trigger a new wave of state AG enforcement actions and private litigation against national banks based on violations of state consumer protection laws and regulations.

Reid F. Herlihy, Ronald K. Vaske, John L. Culhane, Jr. & Alan S. Kaplinsky

Bank of America, N.A. has filed its merits brief in Cantero v. Bank of America, N.A., the case currently before the U.S. Supreme Court dealing with the scope of national bank preemption. The petitioners must file their reply brief by February 16, 2024. (The petitioners’ merits brief is available here.)

A New York statute requires the payment of interest on mortgage escrow accounts and the question before the Supreme Court is whether the National Bank Act (NBA) preempts application of the New York statute to national banks. Reversing the district court, the Second Circuit concluded that a state law is preempted if it “would exert control over [a national bank’s] banking power.” The Second Circuit held that the New York law was preempted as to the named plaintiff whose mortgage pre-dated (and thus did not implicate) Dodd-Frank because the law “exert[ed] control over” a national bank’s power to provide escrow services in connection with home mortgage loans. It also held that the New York law was preempted as to the two named plaintiffs whose mortgages post-dated Dodd-Frank. According to the Second Circuit, because Dodd-Frank “codif[ied] the ordinary rules of preemption,” the New York law was preempted under the same analysis as that used for the named plaintiff whose mortgage did not implicate Dodd-Frank.

In its brief urging the Court to affirm the Second Circuit’s decision, the Bank makes the following principal arguments:

- The New York law is preempted under ordinary preemption principles which provide that the NBA preempts state laws that control the exercise of federally-granted banking powers by attaching state law conditions. The New York law controls the power of national banks to offer escrow accounts by forcing them to pay interest that federal law does not require and impermissibly conditions the exercise of national bank powers on compliance with state law. The NBA expressly empowers national banks to engage in real estate lending, i.e. to offer mortgages, and also gives national banks “all incidental powers…necessary to carry on the business of banking.” Those incidental powers include offering mortgage escrow accounts. The NBA made national banks’ real estate powers subject to only two limitations: (1) uniform regulations prescribing standards for mortgages issues by federal banking agencies, and (2) any restrictions and requirements the Office of the Comptroller of the Currency (OCC) may prescribe. When Congress wanted to give states a role over core banking functions like setting interest rates, Congress did so by amending the Truth in Lending Act to mandate the payment of interest on escrow accounts for high-interest-rate mortgages “if prescribed by applicable State or Federal law.”

- The New York law is also preempted under Dodd-Frank. Dodd-Frank Section 1044 (12 U.S.C. Sec. 25b) “clarified” that a state consumer financial law is preempted when, “in accordance with the legal standard for preemption in the decision of the Supreme Court of the United States in Barnett Bank…, the State consumer financial law prevents or significantly interferes with the exercise by a national bank of its powers.” By incorporating “the legal standard for preemption” in Barnett Bank, “Congress presumptively ratified the consensus circa 2010 as to what Barnett Bank meant.” As of 2010, no circuits applied Barnett Bank to require proof that a state law would effectively foreclose national banks from exercising their powers. Rather, a showing that a state law sought to control federally conferred powers was sufficient under Barnett Bank to find that such state law was preempted by the NBA.

- The “significant interference” standard in Barnett Bank does not require near total impairment of national banks’ powers nor does it require a practical inquiry into the degree to which a state law interferes with national banks’ exercise of their powers.

- The requirement in Dodd-Frank that a preemption determination by the OCC must be made by regulation or order on a case-by-case basis does not mean that a court cannot make a preemption determination without factual proof about the degree of a state law’s impact on a national bank. Before and after Dodd-Frank, courts apply Barnett Bank to determine preemption.

- A requirement for a fact intensive inquiry into whether a state law would effectively foreclose a national bank power “would produce intolerable instability as to what state laws are actually preempted, when, and as to which banks.” Preemption is ordinarily a legal test and “transforming it into a fact-specific inquiry would leave banks and regulators guessing what state laws are preempted.” States could impose regulations “that strike at the heart of bank powers from mortgage terms to loan fees, so long as those regulations do not practically stop banks from offering a product or service.” In addition, there would be no guidance for banks and courts “on how much regulation is too much, leaving preemption determinations to shift with market conditions and judges’ economic assessments.”

Oral argument is scheduled for February 27, 2024. The Justice Department (DOJ) has filed a motion with the Supreme Court seeking leave to participate in the oral argument as amicus curiae and for divided argument. DOJ filed an amicus brief in support of vacating the Second Circuit’s decision. In its brief, DOJ argues that the Second Circuit’s conclusion that a state law is preempted if it attempts to “control” a national bank’s exercise of its powers “runs counter to the ordinary meaning of the term ‘significantly interferes with’; it is inconsistent with Congress’s evident expectation that preemption determinations will rest on practical degree-of-interference assessments; and it does not account for this Court’s many decisions holding that the NBA did not preempt various state laws regulating national banks’ banking activities.” In its motion for leave to participate, DOJ states that the petitioners have consented to the motion and agreed to cede ten minutes of their argument time to DOJ. DOJ also notes that “the United States has previously presented oral argument as amicus curiae in cases concerning the interpretation and application of the Dodd-Frank Act and the NBA,” with Watters v. Wachovia Bank and Barnett Bank cited as examples.

John L. Culhane, Jr., Ronald K. Vaske, Reid F. Herlihy & Alan S. Kaplinsky

Our special guest is Zarik Khan, Founder of Finsolute Advisors. In October 2023, the Federal Reserve Board issued a proposal to lower the maximum interchange fee that a large debit card issuer can receive for a debit card transaction. We first look at the roles of the various parties involved in a typical transaction in which a consumer uses a debit card to make a purchase from a merchant and the various fees imposed in connection with the transaction. We then discuss how the current debit interchange fee cap contained in the Fed’s final rule implementing the Durbin Amendment (Regulation II) that went into effect in October 2011 has impacted each of the parties involved in a typical debit card transaction, the Fed’s rationale for its new proposal and related study, and the proposal’s implications for each of the parties. We conclude with a discussion of the proposal’s prospects and the potential impact of a U.S. Supreme Court decision overruling Chevron on the proposal if implemented.

Alan Kaplinsky, Senior Counsel in Ballard Spahr’s Consumer Financial Services Group, hosted the conversation.

To listen to the episode, click here.

In October 2023, the Federal Reserve Board issued a proposal to lower the maximum interchange fee that a large debit card issuer can receive for a debit card transaction. The due date for comments on this proposal, originally February 12, 2024, has been extended to May 12, 2024. The Consumer Bankers Association (CBA) recently commissioned research on debit card interchange fee limits and the potential implications if the proposal to reduce debit interchange caps is finalized. Nick Bourke, former Director of Consumer Finance at The Pew Charitable Trusts, published a new white paper entitled “How Proposed Interchange Fee Caps Will Affect Consumer Costs.”

The white paper analyzes the initial effects of Regulation II since its implementation in 2011 and estimates the outcome of further reductions to debit card interchange. The key findings from the white paper include:

- Data supports that free accounts became less common, minimum monthly balance rose, and “monthly maintenance fees increased in an amount equal to 42% of the overall reduction in interchange revenue” when bank interchange revenue dropped;

- Economists conclude that it is “virtually impossible” to prove or measure any merchant or consumer savings; and

- Consumers can expect to pay an extra $1.3 billion to $2 billion annually in bank account fees through higher monthly maintenance fees or increases to other service fees.

This week’s Consumer Finance Monitor podcast episode, Understanding the Federal Reserve Board Proposal to Lower Interchange Fee Cap for Debit Card Transactions, features Zarik Khan, Founder of Finsolute Advisors. The episode discusses the impacts of the current debit interchange fee cap, the Federal Reserve Board’s rationale for its new proposal and related study, the proposal’s implications for each of the affected parties, and the potential impact of the U.S. Supreme Court’s pending decision in Loper Bright Enterprises v. Raimondo and Relentless, Inc. v. U.S. Department of Commerce as to whether the Court should uphold or modify the Chevron doctrine.

Ballard Spahr to Hold February 28 Webinar on FTC Developments

In recent years, the Federal Trade Commission (FTC) has been active in enforcement and policy initiatives in a number of developing consumer financial areas. Based on its active agenda in 2023, 2024 promises to be another year of significant activity for the FTC.

On February 28, 2024, from 1:30 p.m. to 2:30 p.m. ET, we will hold a webinar, “The Federal Trade Commission: Looking Back at 2023 and Looking Ahead to 2024 and Beyond.” Malini Mithal, Associate Director of the Federal Trade Commission’s Division of Financial Practices, will join us to review highlights of FTC regulatory and enforcement activity in 2023 directed at protecting consumers and small businesses and to discuss what to expect from the FTC in 2024 and beyond.

For more information and to register, click here.

DOJ Settles with Patriot Bank for Redlining in Memphis

The Department of Justice (DOJ) announced that Patriot Bank (Patriot or Bank) has agreed to pay $1.9 million to resolve allegations that the Bank engaged in a pattern or practice of redlining majority-Black and Hispanic neighborhoods in Memphis, Tennessee from 2015 to at least 2020, in violation of the Fair Housing Act (FHA) and the Equal Credit Opportunity Act (ECOA).

According to the complaint, Patriot’s self-designated assessment area consists of three contiguous counties in southwest Tennessee (Fayette, Shelby, and Tipton). Shelby County, where the City of Memphis is located, contains 97.8% of the majority-Black and Hispanic census tracts and 95.9% of the Black and Hispanic population in Patriot’s assessment area.

The DOJ alleged that Patriot engaged in the following discriminatory practices, among others:

- Locating nearly all branches, loan production offices, and mortgage officers in majority-white neighborhoods and avoiding having branches, offices or loan officers serve majority-Black and Hispanic areas. Although 57.5% of the census tracts in the Bank’s assessment area are majority-Black and Hispanic, only two of Patriot’s six branches were located in a majority-Black and Hispanic neighborhood.

- Adding Shelby County to its assessment area in 2012, but failing to open another loan production office until 2017, followed by a branch in 2019, both of which were located in majority-white areas.

- Concentrating outreach and marketing to majority-white neighborhoods.

- Advertising on social media that the Bank serves “markets of North and East Shelby County, Tipton County, and West Fayette County” although western Shelby County (where the city of Memphis is located) is also within the assessment area.

- Assigning all its loan officers to branches and production offices in majority-white areas, which provided those branches and offices with walk-in mortgage-lending services. These services were not available at either of the two branches located in a majority-Black and Hispanic neighborhoods.

- Marketing on radio stations, billboards, and other mediums in a manner that targets majority-white areas, and avoiding marketing in majority-Black and Hispanic neighborhoods.

- Receiving only 8.4% of the Bank’s mortgage applications from majority-Black and Hispanic areas, while the Bank’s peers generated 29.6% of their applications from these same majority-Black and Hispanic neighborhoods.

- Making only 7.6% of the Bank’s mortgage loans in majority-Black and Hispanic areas, while the Bank’s peers made 22.6% of their mortgage loans in the same majority-Black and Hispanic neighborhoods.

The consent order includes common remedies required by the DOJ to settle redlining allegations. Specifically, Patriot has agreed to:

- Submit a report on the Bank’s efforts to assess community credit needs, and continue to monitor and assess the lending opportunities in the majority-Black and Hispanic census tracts in the Memphis lending area.

- Maintain the fair lending compliance management program, which was implemented based on a consultant’s 2021 assessment.

- Offer fair lending training to staff and officers, and implement a system for each individual to acknowledge that they completed the training and had opportunity to ask questions.

- Allow the Director of Community Lending to monitor the Bank’s compliance with the consent order, and provide reports on at least a quarterly basis to the Bank’s Board of Directors and Chief Executive Officer regarding the Bank’s compliance.

- Maintain at least one full-time loan officer in the Bank’s recently opened full-service branch in a majority-Black and Hispanic census tract in the City of Memphis, and maintain at least one full-time mortgage loan officer responsible for the two branches in a majority-Black and Hispanic census tract in the City of Covington.

- Invest a minimum of $1.3 million in a loan subsidy fund to increase credit for home mortgage loans made in majority-Black and Hispanic census tracts in its Memphis lending area.

- Spend a minimum of $125,000 per year (at least $375,000 over the term of this consent order) on advertising, outreach, consumer financial education, and counseling initiatives targeted to majority-Black and Hispanic census tracts in the Memphis lending area.

Based on recent redlining consent orders, it appears both the bank’s asset size and lending volume are factors that contribute to the amount of the loan subsidy fund and other monetary elements provided for in the consent orders, with loan volume appearing to be the more significant factor. Compared to other redlining settlements, Patriot’s required monetary commitments is relatively low. It appears that after the DOJ notified the Bank of the investigation, the Bank initiated efforts to address the fair lending concerns, such as completing a community credit needs assessment, receiving a consultant’s report on the effectiveness of its fair lending compliance program, opening a full-service branch in a majority-Black and Hispanic census tract, and creating a special purpose credit program for home purchase and home improvement loans in majority-Black and Hispanic census tracts. As a result, the consent order provides for the Bank continuing various remedial measures that it had implemented, rather than implementing the measures. This may have contributed to the relatively low monetary commitments. Significantly, the term of the consent order is only for three years instead of the typical five years.

As previously reported, in the case CFPB v. Townstone Financial, the U.S. Court of Appeals for the Seventh Circuit is currently considering whether the ECOA applies to prospective applicants, thus creating uncertainty as to whether redlining claims may be brought under the statute. Despite this uncertainty, the DOJ asserted in the complaint against the Bank that redlining is one type of discrimination prohibited by the ECOA.

Richard J. Andreano, Jr., John L. Culhane, Jr. & Loran Kilson

On January 24, 2024, a week after issuing its proposed rulemaking for overdraft services, the Consumer Financial Protection Bureau (CFPB) issued its proposed rulemaking on non-sufficient funds (NSF) fees.

NSF Fee Proposal

Banks typically charge NSF fees when an item is submitted for payment against a consumer’s account and returned unpaid due to insufficient funds. The CFPB is seeking to prohibit NSF fees on debit card transactions and some person-to-person (P2P) payments that are declined instantaneously or near-instantaneously. In doing so, the CFPB is attacking a “junk fee” that, by its own admission, is “rarely charged.”

The CFPB states that it is only aware of very limited situations where NSF fees have been charged for declining debit card authorizations and ATM withdrawals or P2P payments and gives prepaid accounts as an example. While the CFPB recognizes that banks routinely only charge NSF fees for returned check and ACH payments, CFPB Director Rohit Chopra states that the CFPB’s proactive approach is necessary because “large banks and their consultants have concocted new junk fees for fake services that cost almost nothing to deliver.” Director Chopra provides no examples of this. As we have previously blogged, the CFPB’s own data shows that many banks have proactively stopped charging any NSF fees and indicates an overall decline in NSF fees charged since 2019.

In proposing the NSF fee rule, the CFPB is using its authority under the Consumer Financial Protection Act to prohibit unfair, deceptive or abusive acts and practices. The CFPB states that charging fees for transactions declined in real time is an abusive practice but as we discuss below its analysis is weak at best given the standards it has adopted for determining when conduct is abusive. In April 2023, the CFPB issued a policy statement defining abusive acts or practices, indicating that it finds two categories of conduct generally abusive: (1) actions that obscure important features of a product or service, and (2) actions taking unreasonable advantage of consumers in certain circumstances. The CFPB preliminarily finds that a consumer who would be charged an NSF fee on a transaction subject to the rule would lack awareness of their available account balance and lack understanding of their account’s material risks, costs, or conditions at the time they initiated that transaction.

The CFPB is not attempting to shoehorn the NSF fee prohibition into an existing regulation as it is attempting to do with overdraft services through amendments to Regulation Z. Instead, the CFPB is proposing to create a new regulation (12 CFR Part 1042) while borrowing the definitions of “account,” “prepaid account,” and “covered financial institution” from Regulation E. The proposed rule seeks to ban any fees charged on a “covered transaction,” which would be defined as “an attempt by a consumer to withdraw, debit, pay, or transfer funds from their account that is declined instantaneously or near-instantaneously by a covered financial institution due to insufficient funds.” A “covered financial institution” would be defined as “a bank, savings association, credit union, or any other person that directly or indirectly holds an account belonging to a consumer, or that issues an access device and agrees with a consumer to provide electronic fund transfer services, other than a person excluded from coverage of this part by section 1029 of the Consumer Financial Protection Act of 2010, title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Public Law 111-203, 124 Stat. 1376.” NSF fees charged for check and ACH transaction would not be covered by the rule. Therefore, the proposed rule is attempting to cover ATM and one-time debit card transactions for which an opt-in is required to charge an overdraft fee. The NSF fee prohibition applies regardless of the label used by the financial institution to charge the fee.

The CFPB solicits comment on the proposed definition of covered transaction, including whether: (1) the timing component is sufficiently clear to determine coverage; (2) the proposed definition appropriately accounts for emerging payment networks and technology innovations; and (3) the proposed definition captures the scope of relevant transactions where “potential” abusive practices are occurring in the market or are at risk of occurring in the future.

This proposed rule is expected to have limited impact on banks’ current practices as these fee are not routinely charged and we are unware of any bank considering the initiation of new NSF fees in this regulatory environment. Nonetheless, this is a gateway rule and the arguments made for calling these types of NSF fees abusive could be used as precedent and applied to all NSF fees in future enforcement actions or rulemaking. Comments are due by March 25, 2024.

The CFPB did not conduct a Small Business Regulatory Enforcement Fairness Act review for this rulemaking as urged by the financial trade groups, summarily stating that the proposed rule should not have a significant impact on a substantial number of small entities.

The Consumer Bankers Association (CBA) issued the following statement:

The CFPB’s proposed rule is a marked departure from the agency’s previous disclosures about the rulemaking, in that the proposal would only impact transactions that are declined “instantaneously or near-instantaneously.” It would explicitly not cover check and ACH transactions. Accordingly, we will work with our members to understand what, if any, business practices would actually be impacted by the Bureau’s rulemaking.

In particular, although the rulemaking acknowledges that ‘many financial institutions in recent years have stopped charging NSF fees,’ the agency relies heavily on ten-year-old data to justify the creation of yet another rule. CBA looks forward to working constructively with our regulators, beyond what appears to be its recent clamoring for headlines, to seek solutions to problems that American consumers are actually facing as they try to make ends meet.

CFPB Formulation of UDAAP Abusive Prong

We agree with the CBA. Moreover, we have significant concerns about the incredibly broad approach set forth by the CFPB in the preamble to the proposal regarding the abusive prong of UDAAP.

Pursuant to the Dodd-Frank Act, the CFPB may not find an act or practice to be abusive unless the act or practice:

(1) materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service; or (2) takes unreasonable advantage of—(A) a lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service; (B) the inability of the consumer to protect the interests of the consumer in selecting or using a consumer financial product or service; or (C) the reasonable reliance by the consumer on a covered person to act in the interests of the consumer.

The proposal reflects a preliminary determination by the CFPB that the imposition of an NSF fee for a covered transaction takes unreasonable advantage of a lack of understanding on the part of the consumer of the material risk, costs, or conditions of the product or service. Even though the CFPB acknowledges that many consumers can instantly access their existing account balances, without an adequate explanation, “the CFPB preliminarily concludes that consumers initiating covered transactions that incur NSF fees would generally lack awareness of their available account balance.” The CFPB also preliminarily concludes, again, without an adequate explanation, that such consumers “would generally lack awareness of . . . other information about the material risks, costs, or conditions regarding their account,” regardless of whether the consumer knew that an NSF would be imposed for a declined covered transaction based on a prior declination of a covered transaction or a disclosure provided to the consumer.

The incredibly broad interpretation that the CFPB seeks to apply to aspects of the abusive concept is reflected in the following statement by the CFPB in the preamble to the proposal:

“At the time a consumer considers initiating a request to withdraw, debit, pay, or transfer funds from their account, the relevant risks to the consumer would include the possibility the transaction will be declined and result in an NSF fee. Furthermore, once a consumer actually initiates a covered transaction, it is certain that the transaction will be instantaneously declined and they will be charged a fee; therefore, the likelihood of harm at that time is 100 percent. This is because no chance occurrence, consumer choice, or other intervening event can happen between the transaction’s initiation and the instantaneous decline that could change the harmful outcome (i.e., the assessment of the fee). In other words, for covered transactions that are initiated, the risk of harm is a certainty. Therefore, a consumer who initiates such a transaction believing the transaction nevertheless might go through would lack understanding of the likelihood of harm. Given the tangible and negative consequences of both a transaction decline and the imposition of a fee, the CFPB interprets this risk, if and when present, to be material.”

Essentially, the CFPB is taking the position that a consumer can be blissfully ignorant of something within their control, such as their account balance, and the disclosures and account agreements that have been provided to them. How far might the CFPB go? Might it take the position that even though a credit card late fee was disclosed to and agreed to by the consumer, and that making the monthly payment on time is within the control of the consumer, gee the consumer would have to read the disclosure and account agreement, and then remember and have the funds to make an on-time payment, so actually imposing a late fee for a late payment, even at a significantly reduced amount based on an upcoming CFPB rulemaking, takes unreasonable advantage of a lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service.

Take the example of a consumer who knew an NSF would be imposed for a declined covered transaction. The consumer is considering attempting a covered transaction and realizes that, based on their account balance, the transaction may not go through. The consumer nonetheless decides to take the risk and attempts the transaction, the transaction is declined and an NSF fee is imposed. In the view of the CFPB, in this example the consumer lacked the understanding of the material risk, costs, or conditions of the product or service. That’s absurd. Even if a consumer does not keep their own accounting of their balance, consumers can easily access their balances through phone banking, online banking, mobile banking or at an in-network ATM. The consumer is in the best position to know their account balance and the checks they wrote and electronic payment authorizations they made. If the CFPB takes such broad a view of this aspect of the abusive concept, it could find that most any act or practice that it dislikes is abusive. The “bottom line” is that Director Chopra does not subscribe to the well-accepted adage: “If it ain’t broke, don’t fix it!”

Kristen E. Larson, Alan S. Kaplinsky, John L. Culhane, Jr. & Richard J. Andreano, Jr.

FinCEN Analysis Reveals $212 Billion in Identity-Related Suspicious Activity

The Financial Crimes Enforcement Network (FinCEN) recently released a Financial Trend Analysis (FTA) focusing on identity-related suspicious activity. The FTA was issued pursuant to section 6206 of the Anti-Money Laundering Act of 2020, which requires FinCEN to periodically publish threat pattern and trend information derived from BSA filings.

FinCEN examined information from Bank Secrecy Act (BSA) filings submitted in the 2021 calendar year. According to FinCEN’s analysis, 1.6 million “BSA filings” – presumably, the vast majority of which constituted Suspicious Activity Reports (SARs) – were identity-related, representing a total of $212 billion in suspicious activity. These filings constituted 42% of filings for that year, thereby meaning that approximately 3.8 million SARs were filed in 2021.

The descriptions and the explanations in the FTA necessarily turn on how the SAR filings chose to describe the suspicious activity at issue. This is presumably why most of the activity falls into the vague category of “general fraud” – because, apparently, this is the particular box on the SAR form which most of the SAR filers happened to choose. However, and we will describe, the activity in fact animating the vast majority of these SARs is some form of identity theft.

Key highlights from the analysis include:

- In 69% of identity-related BSA reports, attackers were found to have impersonated others.

- General fraud is the most reported typology, with 1.2 million BSA reports totaling $149 billion in suspicious amounts. The next two most reported typologies were false records and identity theft, respectively.

- Depository institutions account for the highest percentage of BSA reports at fifty-four percent, followed by money services businesses at 21 percent.

- There is a significant number of identity-related abuses based on BSA report volumes and dollar values.

Tactics: Impersonation, Circumvention, and Compromising Authentication

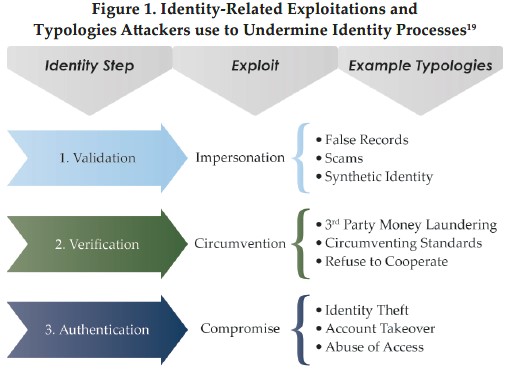

FinCEN identified three ways fraudsters exploit identity processes, they: (i) impersonate others to avoid validation; (ii) circumvent or exploit inadequate verification processes; and (iii) use compromised credentials to gain unauthorized access during authentication. The following graphic summarizes how “[a]ttackers target vulnerabilities in virtual and physical environments to steal sensitive information, compromise financial activity, and disrupt business operations.”

According to the analysis, 69% of BSA reports indicate fraudsters impersonated others as part of their efforts to defraud victims, while 18% of reports described instances of bad actors using compromised credentials to gain unauthorized access, and 13% cited exploitation of weak or insufficient verification processes.

The report found that most financial institutions in the identity-related BSA dataset reported impersonation as their top identity exploitation, money services businesses most often reported circumvention of verification.

Fraud is the Leading Form of Identity-Related Suspicious Activity

FinCEN identified over 14 typologies employed by bad actors to manipulate the validation, verification, and authentication processes used by financial institutions. The top five, including fraud, false records, identity theft, third-party money laundering, and circumventing standards, represent 88% of such reports and 74% of total suspicious activity amount during the review period.

General fraud was the most frequently reported suspicious activity, according to the analysis, both in terms of the number of BSA reports and the total suspicious activity amount. Filers reported fraud in 1.2 million identity-related BSA reports, amounting to $149 billion in suspicious activity. Various types of fraud reported include bust-out schemes, check fraud, credit and debit card fraud, and COVID-19 fraud.

Other commonly reported typologies include:

- False Records: altering, counterfeiting, or forging documentation, records, or forms of payment; documented in approximately 423,000 identity-related BSA reports, involving $45 billion in suspicious activity

- Identity Theft: using identifying information unique to the rightful owner without the rightful owner’s permission; documented in more than 222,000 identity-related BSA reports, representing $36 billion in suspicious activity

- Third Party Money-Laundering: laundering of illicit proceeds by a person who was not involved in the commission of the predicate offense; identified in 154,000 identity-related BSA reports, totaling $18 billion

- Circumventing Standards: lack of adherence to standards or acceptable practices, knowingly or unknowingly; reported in 110,000 identity-related BSA reports, totaling $12 billion

Less common typologies include: account takeover, misuse of access, non-cooperation, cyber incidents, and general scams for a combined total of $82 billion.

Depository institutions filed the greatest number of identity-related BSA reports in 2021 (1.3 million), reporting $201 billion in suspicious activity, according to FinCEN. Money services businesses were the second largest category with 501,000 BSA reports, and securities/futures firms filed 103,000 BSA reports.

The report also found that compromised credentials were disproportionately costly, accounting for 32% of the total suspicious activity amount or $112 billion.

In the effort to combat identity compromise, FinCEN states that it has collaborated with other governmental agencies to establish best practices, and explore ways in which innovations, such as digital identity, artificial intelligence, and privacy-enhancing technologies, can mitigate customer identity abuses.

In the press release accompanying the analysis, FinCEN encouraged financial institutions to work across their internal departments to address these schemes and noted, “Robust customer identity processes are foundational to the security of the U.S. financial system, and critical to the effectiveness of financial institutions’ programs to combat money laundering and counter the financing of terrorism.”

If you would like to remain updated on these issues, please click here to subscribe to Money Laundering Watch. Please click here to find out about Ballard Spahr’s Anti-Money Laundering Team.

FHFA Again Addresses Underutilization of Appraisal Time Adjustments

The Federal Housing Finance Agency (FHFA) recently published another FHFA Insights blog post addressing the underutilization of appraisal time adjustments by appraisers that is a companion to an FHFA Insights blog post that we reported on previously. In the recent blog post, the FHFA presents the question “Is the racial disparity in underappraisal, or some portion of it, due to racial disparities in the practice of time adjustment?”

As is the case with the prior blog post, the recent blog post (1) focuses on situations in which the appraised value is below the contract sales price, which the FHFA refers to as “underappraisals,” (2) notes that underappraisals are particularly an issue during periods of rapid home price growth, and (3) is based on an analysis of a 5% sample of single-family housing in the Uniform Appraisal Dataset (UAD) that Fannie Mae and Freddie Mac collected covering the third quarter of 2018 through the fourth quarter of 2021.

The FHFA observes that “[w]hen we focus on appraisals below the contract price before time adjustments, larger disparities emerge. [The analysis] shows that, among these appraisals, appraisers ultimately time adjust at a 67% rate in white tracts, but only at a 45% rate in Black tracts, a disparity of 22 percentage points. We see disparities of 14 and 7 percentage points when comparing Hispanic and no-majority tracts, respectively, to white tracts.” The FHFA notes that “[t]hese simple comparisons of means understate the disparity because average annual house price growth, an important predictor of time adjustments, is 3 percentage points higher in Black tracts during [the analysis] period.” The home price growth rate for the period was 14% in Black census tracts and 11% in White census tracts.

Based on a regression analysis, the FHFA cites a difference in rates of time adjustments that resulted in a property no longer being under-appraised of 52.2% in White census tracts, compared to 23.7% and 16.0% in Black and Hispanic census tracts, respectively.

House Financial Services Committee Announces AI Working Group

On January 11, 2024, the House Financial Services Committee announced the formation of a bipartisan Working Group on Artificial Intelligence (AI). The working group is to be led by the Chairman of the Digital Assets Financial Technology and Inclusion Subcommittee, French Hill, along with the Subcommittee ranking member Stephen Lynch. This group is designed to address a number of the directives contained in President Biden’s Executive Order on AI issued in October 2023.

The Group will focus on AI’s impact on the financial services and housing industries. A core purpose will be to educate Committee members as to both the potential risks and benefits of AI. Also, it will strive to help the Committee find ways to “leverage AI to foster a more inclusive financial system.” Specifically, the group will explore “the development of new products and services, fraud prevention, compliance efficiency, and the enhancement of supervisory and regulatory tools, as well as how AI may impact the financial services workforce.”

The creation of this group coincides with similar AI efforts by federal agencies, including the FTC and FCC, as well as state agencies such as the California Privacy Protection Agency. It also immediately follows the European Union’s passage of its comprehensive AI legislation, the EU AI Act. Entities seeking to develop or implement AI tools will have to remain vigilant to stay on top of the rapid regulatory developments in this field.

Timothy Dickens

House Tax Bill Would Greatly Accelerate Employee Retention Credit Filing Deadlines

The current draft of the Tax Relief for American Families and Workers Act of 2024 includes a proposed provision that would dramatically accelerate the deadline to file claims for the Employee Retention Credit (ERC) to January 31, 2024. The ERC is a much-scrutinized refundable tax credit of up to $26,000 per employee for certain wages paid by employers between March 12, 2020, and before October 1, 2021. Generally, an employer is eligible for the ERC if (1) it was subject to a COVID 19-related governmental order that wholly or partially suspended its business operations, or (2) it suffered a substantial reduction in gross receipts. The current proposal would move up the filing deadline for all ERC claims to January 31, 2024.

To learn more, read the full Alert here.

Christopher A. Jones & Wendi L. Kotzen

HR 7024: Low-Income Housing Legislation on the Move

Summary

On January 19, 2024, the House Ways and Means Committee approved the bipartisan tax legislation, “The Tax Relief For American Families and Workers Act of 2024“. Two proposed changes to Section 42 of the Internal Revenue Code contained in the Act would boost the amount of Low Income Housing Tax Credits for this year and next year.

***

On January 19, 2024, the House Ways and Means Committee approved the bipartisan tax legislation, “The Tax Relief for American Families and Workers Act of 2024” (H.R. 7024). Sections 501 and 502 of H.R. 7024 (the LIHTC Amendments) would increase the availability to Low Income Housing Tax Credits (LIHTC) provisions under Section 42 of the Internal Revenue Code as follows:

- For 9% LIHTC transactions, H.R. 7024 would increase the state housing credit allocation ceiling by 12.5% for calendar years 2023 through 2025; and

- For 4% LIHTC transactions, the legislation would reduce the minimum amount of volume-cap tax-exempt bonds required to receive 4% LIHTC from 50% to 30% (30% Test). This change would apply to developments financed with tax-exempt bonds with an issue date before 2026 if the building is placed in service after December 31, 2023. There is a transition rule for buildings that already have a bond allocation.

What Does All of This Mean?

Since state housing credit agencies have already awarded 2023 LIHTC, the increase will effectively mean credit allocators will have an additional 25% of LIHTC to award in 2024 and 12.5% in 2025.

The 30% Test is effective for buildings placed in service after December 31, 2023. If there are rehabilitation expenditures, the rehabilitation component of the building is considered placed in service at the end of the rehabilitation expenditures period. The 30% Test is applied to the aggregate basis of both the existing building and the rehabilitation expenditures. The 30% Test will allow bond issuers to “spread” their volume-cap allocations over more projects because less volume cap bonds will be needed per project to generate the same amount of 4% LIHTC. However, with the reduced bond allocation, developers will have to structure the timing of capital contributions to pay for construction costs or find additional gap funding.

What Else and What’s Next?

In addition to the LIHTC Amendments, H.R. 7024 currently includes provisions that would expand the federal Child Tax Credit and enact a number of other business-related tax provisions related to research and experimental costs, deductibility of business interest, bonus depreciation, and expensing of depreciable business assets. The next step is for the full House of Representatives to consider H.R. 7024. If passed, H.R. 7024 will be sent to the Senate for consideration.

Kimberly D. Magrini, Jere G. Thompson, and Peter Lam

Join Ballard Spahr LLP, February 13-16, 2024, at:

NMLS 2024 Annual Conference & Training

San Antonio Marriott Rivercenter, San Antonio, TX

The U.S. Supreme Court’s Decision in the Two Cases Raising the Question of Whether the Chevron Judicial Deference Framework will be Overturned: Who Will Win and What Does It Mean?

A Ballard Spahr Webinar | February 15, 2024, 12:30 PM – 2:00 PM ET

Speaker: Alan S. Kaplinsky

MBA’s Servicing Solutions Conference & Expo 2024

February 20-23, 2024 | Orlando, FL

INNOVATION & TECHNOLOGY TRACK: Cybersecurity in Servicing,

February 22, 2024 – 1:00 PM ET

Speaker: Gregory Szewczyk

The Federal Trade Commission: Looking Back At 2023 And Looking Ahead To 2024 And Beyond

A Ballard Spahr Webinar | February 28, 2024, 2:00 PM – 3:00 PM ET

Speakers: Alan S. Kaplinsky & John L. Culhane, Jr.

RESPRO One-Stop

March 7-8, 2024 | The Houstonian, Houston, TX

Compliance is Key

March 8, 2024 – 9:15 AM ET

Speaker: Rich Andreano

Join Ballard Spahr LLP, May 5-8, 2024, at:

MBA Legal Issues and Regulatory Compliance Conference

Manchester Grand Hyatt, San Diego, CA

Subscribe to Ballard Spahr Mailing Lists

Copyright © 2024 by Ballard Spahr LLP.

www.ballardspahr.com

(No claim to original U.S. government material.)

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, including electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the author and publisher.

This alert is a periodic publication of Ballard Spahr LLP and is intended to notify recipients of new developments in the law. It should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own attorney concerning your situation and specific legal questions you have.